Global economic growth was already expected to moderate to 4.4% and 3.8% in 2022 and 2023 from 4.9% in 2021, according to the International Monetary Fund.

This moderation is driven by diminishing base effects of the deep contraction from the 2020 great recession and the withdrawal of both fiscal and monetary stimulus across major advanced and emerging markets.

Now Russia’s invasion of Ukraine, the ensuing war, and the associated sanctions that have been imposed by the West, are likely to intensify that contraction. Although the events may appear localised, the economic consequences will be global and extend into the long-term.

Foreign direct investment (FDI) trends during and immediately after nine major wars since 1970 and the Brexit vote suggest that South Africa’s ambitions to attract US$100 billion in direct investment, most of it foreign, will likely be stalled. This means that policy makers must be even more determined and aggressive in pushing through structural economic reforms, coupled with extensive showcasing of their progress at every investment conference, for South Africa to stand a chance of achieving FDI targets that will lift economic growth, and reduce unemployment, poverty, and inequality.

Changing the economic policy narrative

When the Ramaphosa administration came into office, it was shortly before economic growth stagnated at 0.1% in 2019, to average 1.4% annually in the decade between 2009 and 2019. Growth in the primary sector averaged 0.6% per annum while the secondary sector averaged 0.1%. The services sector remained resilient with an average of 1.8%.

Hausmann et. al. (2022) explain this stagnation to have been driven by three factors: (1) an external story that includes the end of the commodity price boom; (2) a macro story involving unsuccessful fiscal consolidation efforts after the global financial crisis, as well as a tightening monetary policy to anchor inflation expectations around the 4.5% mid-point of the South African Reserve Bank (SARB) target range of 3%-6%; and (3) a microeconomic story involving tightening product and labour market regulations, mismanagement of State Owned Companies (SOCs), the introduction of the new mining charter, debates about expropriation of land without compensation, and other policy initiatives seen as inhibiting for investments.[1]

There has been little chance to change the economic prospects of the country without changing the narrative about private investment as a requirement for growth. This, in turn, required a change in narrative on economic policy. Thus, the macroeconomic story shifted from unsuccessful efforts at fiscal consolidation to a commitment that saw government reneging, for the first time ever, on the final year of the 2018 public-sector wage settlement, taking on labour all the way to the Constitutional Court and winning. The SARB continued its emphasis on anchoring inflation expectations at the 4.5% mid-point, fending off calls for its nationalisation and pressure for it to be involved in what some called developmental lending.

On the microeconomic side, the government adopted the National Treasury growth paper, which proposed reforms in key sectors such as energy, transport, and telecommunications. Among the outcomes of these reforms is the introduction of equity partners at South African Airways, and the intention to do so at Transnet and Eskom and other key sectors where the state has had a monopoly. These changes were not on the table for discussion a decade ago. It is clear the policy trajectory has changed, although the speed of implementation is slower than desired.

Taking South Africa to the world through investment conferences

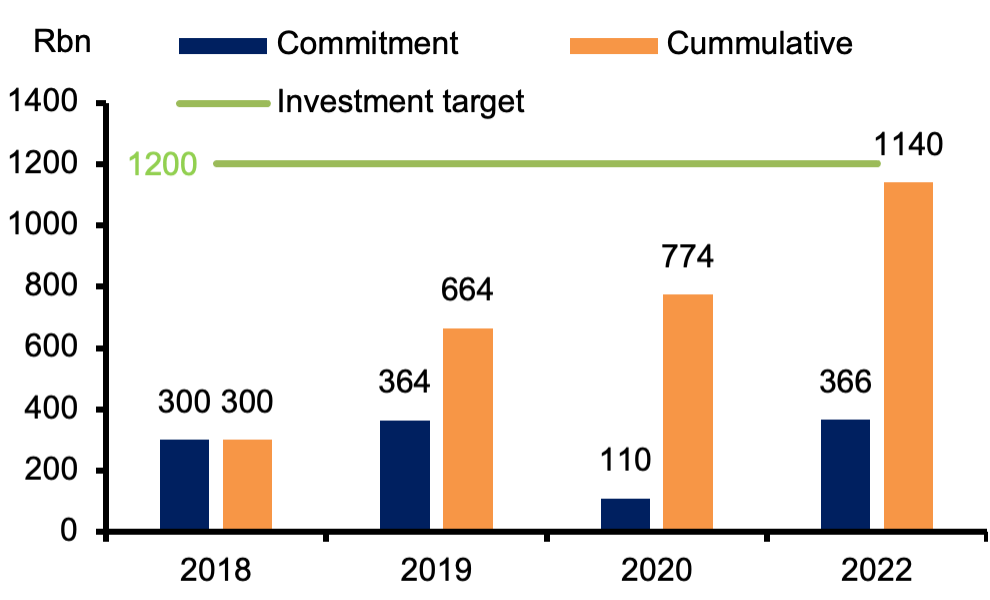

Having put in motion structural economic reforms, South Africa has, since 2018, embarked on a marketing journey through investment conferences aiming to attract US$100 billion in direct investment from both domestic and foreign private sector investors. At the fourth South Africa Investment Conference (SAIC) held on the 24th March, President Ramaphosa announced that investment pledges since the first in 2018 amounted to R1.14 trillion, 95% of the targeted R1.2 trillion, and that of the R744bn pledged from the first to the third investment conferences, R314bn (41%) has been spent. (Figure 1).

The domestic private sector is responding

Actual investment growth suggests the private sector is responding. Following three consecutive years of contracting private sector investment, with average annual growth of -1.2% from 2014 to 2016, investment growth turned positive from 2017 to 2019 until it was interrupted by the Covid-19 pandemic in 2020, when it contracted by 16.2%. In 2021, growth in private sector investment returned to positive territory, accelerating by 3.1%. By comparison, public sector investment is in its sixth year of consecutive contraction, driven by both public corporations and general government, although public corporations registered an acceleration of 3.7% in 2021, the first expansion in six years.

Net foreign direct investment has risen significantly since 2018

Before and after the fourth investment conference, two columnists[2][3] expressed pessimism about the investment pledges. One argument is that such conferences are a waste of money and time that will not result in new investment. Another is that the investment pledges are investments companies would have made anyway. Both these perspectives are wrong and miss a crucial element of the investment story that is overwhelmingly supported by foreign direct investment data.

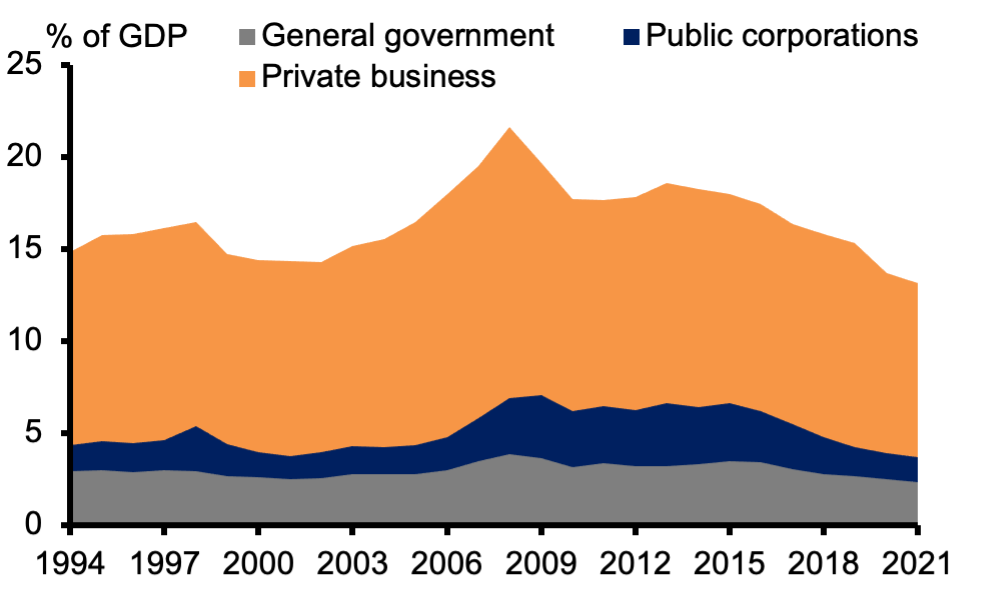

While gross fixed investment continued to decline to 13% as a share of the economy (Figure 2), domestic private investment has shown growth as highlighted above. The statement from the South African Reserve Bank Monetary Policy Committee on 24th March also highlights the resilience of private investments.[4] Net foreign direct investment is more evidence that the trajectory has turned positive.

|

Fig 1. Investment commitments into SA since 2018 |

Fig 2. Gross Fixed Capital Formation in SA |

|

|

|

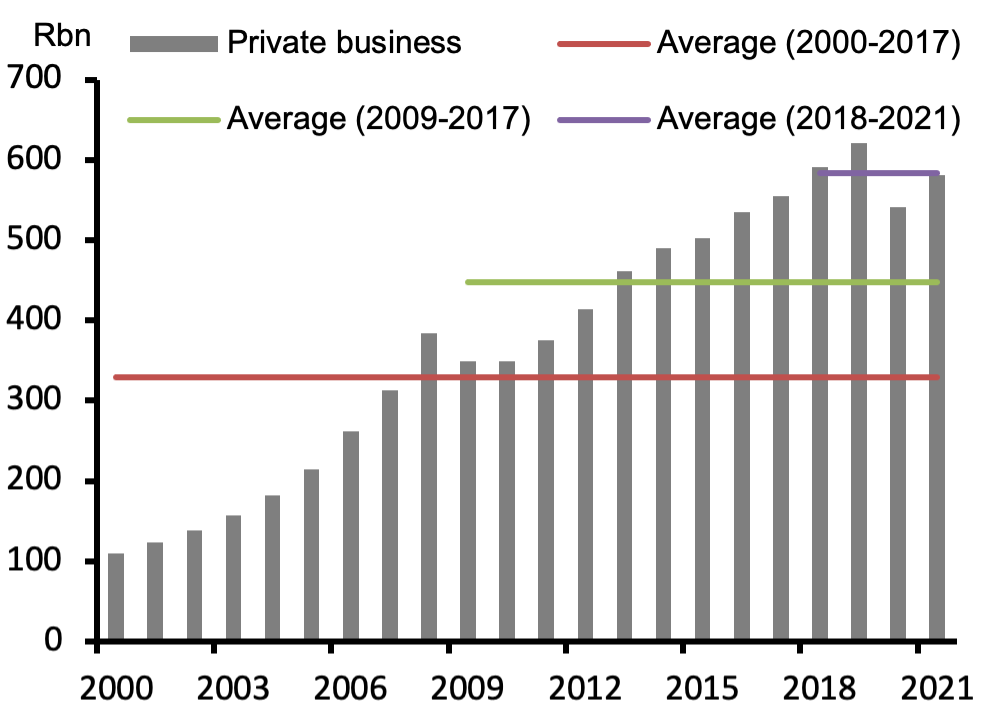

Fig 3. Gross fixed investment by private sector |

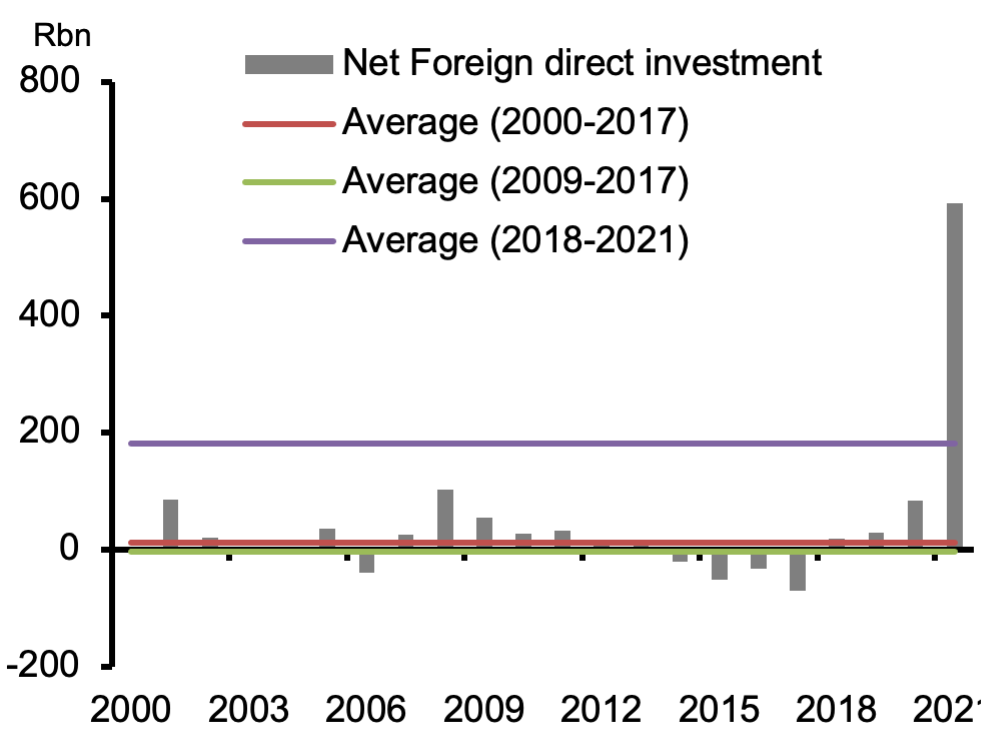

Fig 4. Net foreign direct investment inflows* |

|

|

*2021 net FDI is for the first three quarters of the year. Source: SARB

If we accept that the SAIC is aimed at attracting both domestic and foreign investors, looking at total investment can be misleading. The pre-pandemic peak in nominal investment by the domestic private sector was R621bn in 2019 before declining by nearly 13% to R541bn in 2020. In 2021, private sector investment grew by 7.6% to R582bn, 6% below the pre-pandemic peak. Annual average private sector investment between 2000 and 2017 (before the start of the investment drive) was R329bn, rising to an average of R448bn between 2009 and 2017. Since 2018, private sector investment has averaged R583bn (Figure 3).

On the surface, these figures tell a mediocre story. However, as we explain below, in the context of rising global interest rates and the Ukraine war they tell a different one. The foreign direct investment figure in fact tells a positive story that has been completely missed. The average annual net foreign direct investment between 2000 and 2017 was R11.1bn, while between 2009 and 2017 there was an average net outflow of R3.7bn per annum. If we take the four years prior to the investment drive, from 2014 to 2017, there was a R44.1bn average annual net outflow in foreign direct investment. Foreign investors voted with their money opting to take their capital out of South Africa (Figure 4).

The start of the investment drive in 2018 marked a reversal in this trend. Average annual foreign direct investment inflows amounted to R43.5bn from 2018 to 2020. The first three quarters of 2021 show a continuing positive trend with a step change in the third quarter where net foreign direct investment inflows jumped to R555bn from an average of R16bn in the previous four quarters. The cumulative net foreign direct investment inflows for the 15 quarters since 2018 to the third quarter of 2021 was R723bn compared with net outflows of R176bn in the 15 quarters before the investment drive started. This figure is closer to the investment pledges of R774bn by the time of the third investment conference as announced by the president. The view that the investment conferences are fruitless is strongly dispelled by the data on foreign direct investment flows. Foreign investors are already showing confidence in South African.

But now we face serious risks from the Covid-19 pandemic and the Ukrainian war.

Covid-19 and the Russia-Ukraine war will disrupt investment ambitions

When the Covid-19 pandemic hit, countries looked inward and put more focus on fighting the pandemic. Investment was not a priority. The Russia-Ukraine war will reinforce that trend as potential source countries for foreign direct investment, largely European and the US, will reprioritise spending to fight Russia while the war continues, and to rebuild Ukraine when the war ends. Nations tend to take care of problems closer to home when crises strike. In this regard, historical data offers lessons for us.

FDI flows: lessons from nine wars and the Brexit vote

We look at the response of FDI inflows around nine wars (or geopolitical shocks), and the Brexit vote, to get a sense of what we should expect and what policy makers must do in response. The wars include the Israel-Arab war (oil embargo) in October 1973, the Iranian hostage crisis (1979), the invasion of Grenada (1983), the first Gulf War (1991), the 9/11 attacks (2001), the Iraq War (2003), the war in Libya (2011), the annexation of Crimea (2014), the Brexit vote (2016) and the airstrike on the Syrian airbase (2017).

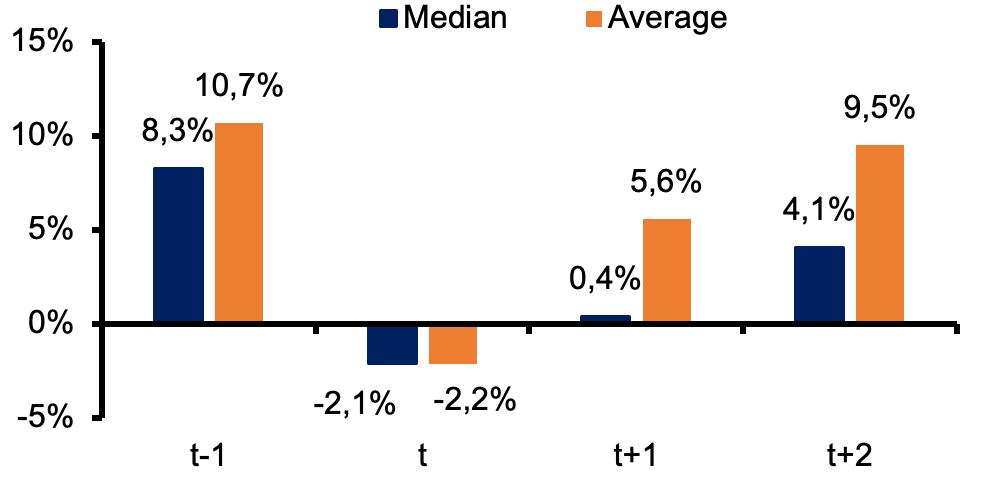

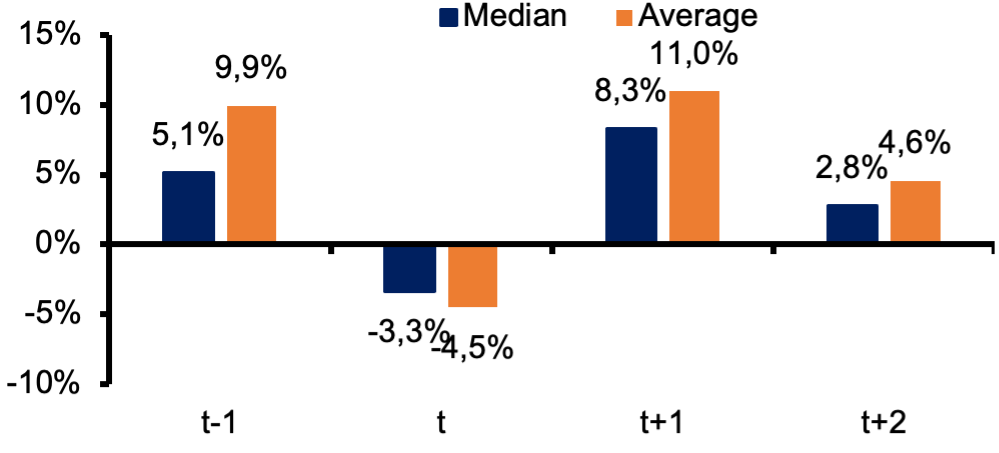

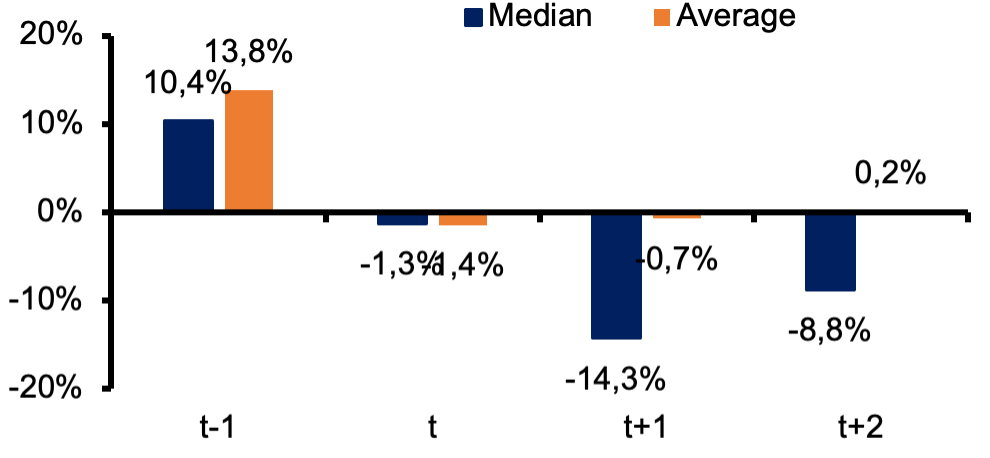

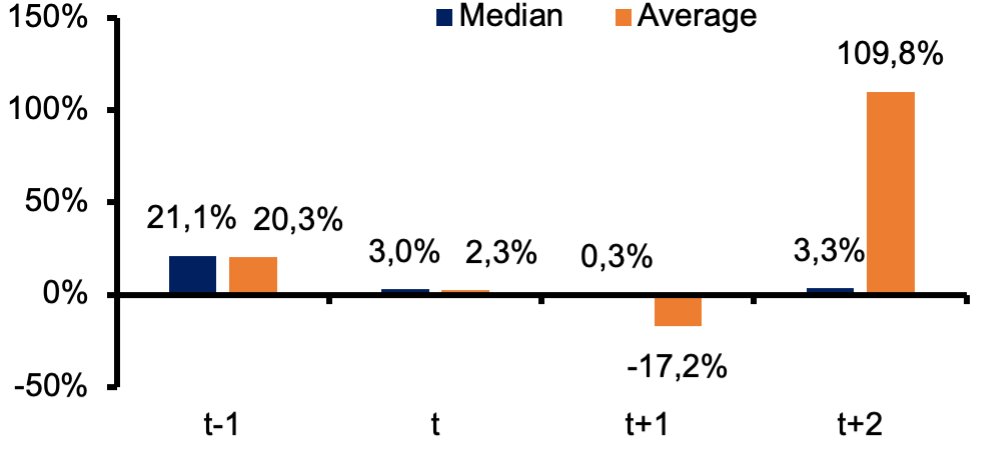

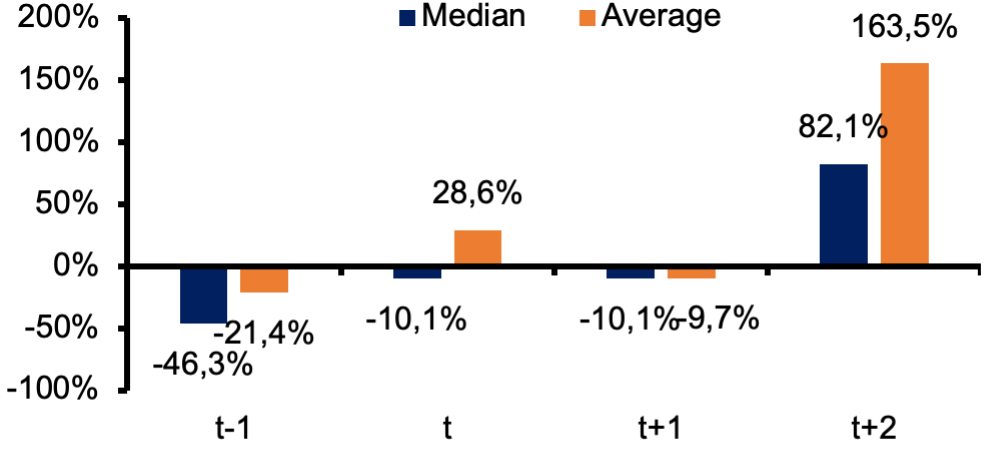

Our objective was to assess the response of foreign direct inflows during the year of the war or geopolitical shock and the two years immediately after. The results appear convincing and show that world FDI inflows contract on average by 2% in the year of the war and recover thereafter but at lower growth rates than the year before the war (Fig 5). At a regional level there are some variations. FDI inflows into developed markets contract during the year of the war by an average of 4.5% and recover to pre-war growth rates the year after (Fig 6). Emerging markets show a different pattern; FDI inflows remain resilient in the year of the war and contract by an average of nearly 1% the year after, followed by significant growth in year two (Fig 7).

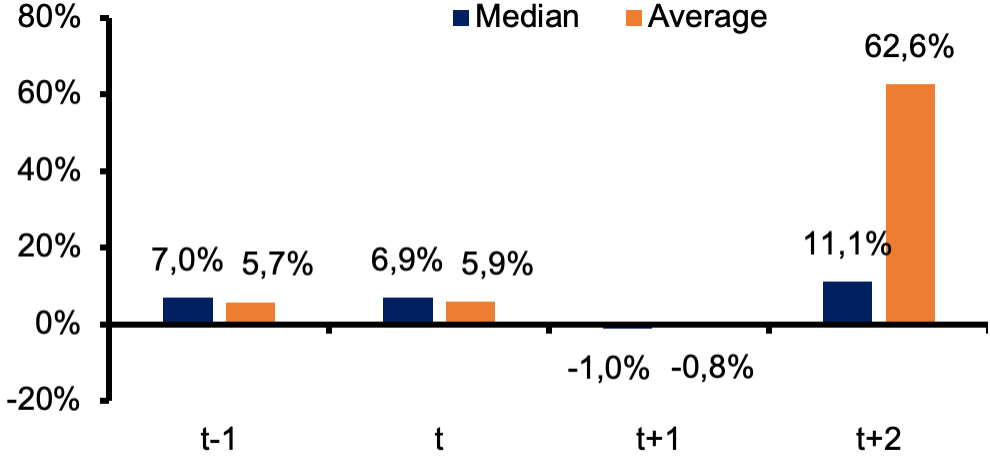

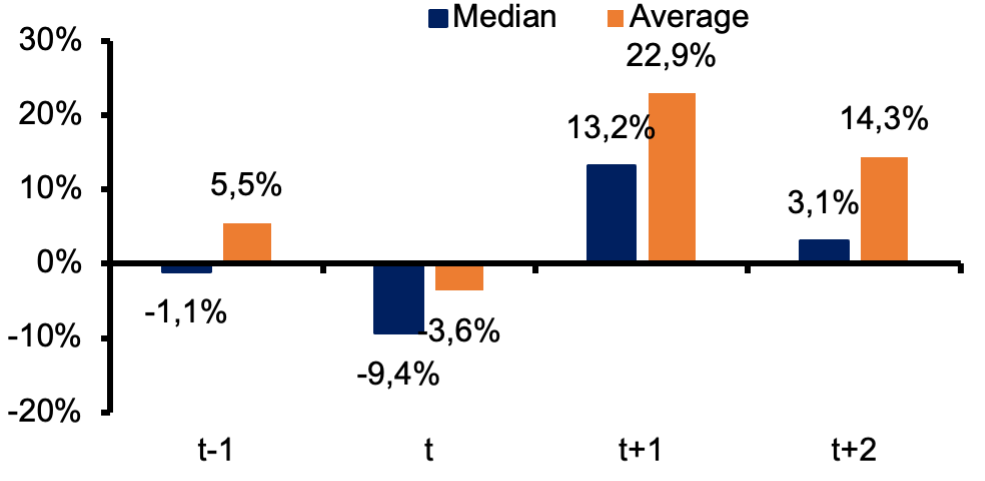

FDI inflows into America tend to contract by an average of 3.6% followed by a significant recovery the year after the war (Fig 8). Europe takes a bigger hit during the year of the war and in the two years after the war (Fig 9). Asia shows a somewhat similar picture, with FDI inflows contracting during the year of the war and the year after (Fig 10). Africa has somewhat different dynamics: FDI inflows contract by an average of 10% a year before the war[5] and return to positive territory the year after (Fig 11). FDI inflows into South Africa contract a year before the war and recover in the year of the war, and then contract the year after. (Fig 12).

|

Fig 5. World FDI inflows |

Fig 6. Developed markets FDI inflows |

|

|

|

Fig 7. Emerging markets FDI inflows |

Fig 8. America FDI inflows |

|

|

|

Fig 9. Europe FDI inflows |

Fig 10. Asia FDI inflows |

|

|

|

Fig 11. Africa FDI inflows |

Fig 12. South Africa FDI inflows |

|

|

UNCTAD and Author’s calculations

South Africa’s position on the Ukraine war: lessons from World Wars One and Two[6]

The South African government and the ruling party has taken a neutral position on Russia’s invasion of Ukraine. This comes with economic risks given that South Africa is highly integrated into the global financial system and is a recipient of FDI investment, which is mainly from the West. The channels of impact could come through foreign companies being sceptical about investing in South Africa due to fear of the potential impact of sanctions on South African companies that might be doing business with Russian companies. Effectively, South Africa might be deemed guilty by association, thus there may be spillover impact.

Faraway conflict but local consequences

Faraway conflict but local consequences

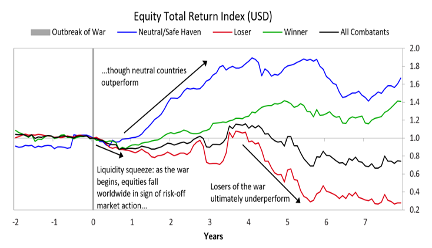

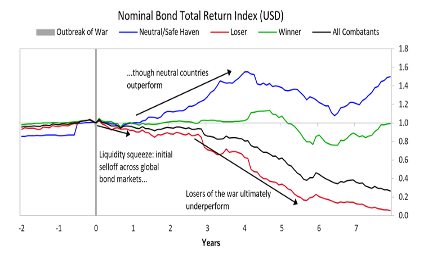

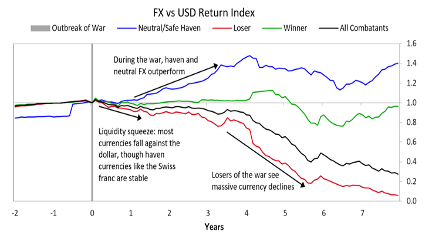

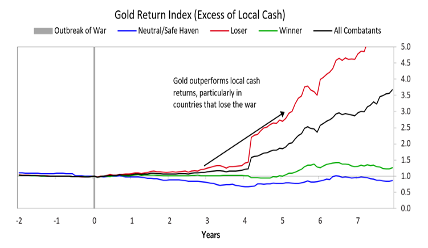

In the previous section, we show that major wars have a medium- to longer term impact on FDI inflows. However, financial markets respond instantaneously and still have medium- to longer-term behaviour depending on which side of a war a country takes. Countries are divided between those that have imposed sanctions on Russia and those that have refrained from doing so. More so, there is always a winner and a loser in war though no country escapes the damages, even those not directly involved.

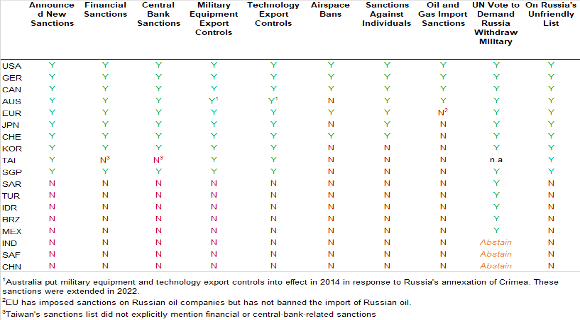

Table 1: Two sides of the Ukraine war – recent action against Russia[7]

Source: Dalio R. (2022) The Past Is Prologue: The Changing World Order; How the Sides Are Lining Up.[8]

Table 1 above shows that South Africa (SAF) has adopted a neutral position, along with Saudi Arabia (SAR), Turkey (TUR), Indonesia (IDR), Brazil (BRZ), Mexico (MEX), India (IND), and China (CHN). There has been condemnation of the government for taking such a position in the face of a humanitarian crisis in Ukraine.

Putting morality aside, Ray Dalio, the Co-Chief Investment Officer & Chairman of Bridgewater Associates, shows that it pays to be neutral.[9] Countries that remained neutral during WWI and WWII experienced better total returns on equities and bond markets, better currency performance relative to the US dollar, and lower cash excess returns over gold. (Fig 13 to 16).

|

Fig 13. Equity total return index |

Fig 14. Nominal Bond return Index |

|

|

|

Fig 15. FX vs USD return index |

Fig 16. Gold return index (excess of local cash) |

|

|

Source: Dalio R. (2022)

This might also help to explain why South African markets have been resilient in an environment where investors are shifting their funds to safe haven markets. Another factor helping South Africa is that other major emerging markets are economically and institutionally weakening due to domestic factors. Brazil has a macroeconomic environment with a drought and an uncertain election this year. Turkey has been in far worse macroeconomic and financial shape with several changes of central bank governors that undermined monetary policy. Mexico had its president recently announcing an interest rate change before the central bank announced it. Russia is under severe sanctions after it invaded Ukraine. China’s crackdown on the property and technology sectors has also resulted in moderating economic growth. This makes South Africa stand out as a positive investment case in relative terms.

Conclusion

South Africa has been on an investment drive since 2018. Against popular rhetoric that these investment drives are hype and not adding any value, data on foreign direct investment flows shows that investors are, in fact, investing and the investment conferences are bearing fruit.

Domestic economic growth is now moderating at a time when the global environment is facing rising interest rates and the withdrawal of fiscal stimulus. The Covid-19 pandemic and now the Russia-Ukraine war are bad news for South Africa, as much as they are for the rest of the world. The lessons from the previous nine wars around the world show it is going to be even harder for South Africa to attract FDI this year until the war in Ukraine ends. The West will likely divert funds and concentrate on funding Ukraine and rebuilding it after the war.

The implication is that funds that have been pledged but not committed to South Africa, including those for financing the just energy transition, will likely be delayed.

The fact that other emerging markets are deteriorating economically and institutionally will amplify how South Africa is viewed. Policy makers therefore need to be more determined to implement economic reforms and to market South Africa - through investment conferences and in other ways - to ensure the country remains top of mind for international investors even as the Ukraine war rages on. Failure to do this may mean that the dividend from implementing economic reforms might not be fully realized.