Pesticides that have been linked to cancer, genetic mutations, and which might affect reproductive health have been recognised as a threat to the safety of our food supply for decades.

Green hydrogen sounds like a win for developing countries. But cost and transport are problems

- Hits: 885

What is hydrogen used for?

As the world’s leaders gathered in New York this week for the annual United Nations General Assembly meetings, it was one of the more unlikely buzzwords: fertilizer.

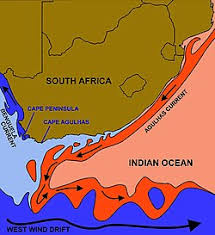

South Africa is surrounded by sea but doesn’t have a plan to protect it: three steps to get one

- Hits: 687

South Africa is surrounded by 2,798km of coastline. Yet, oddly, the country doesn’t have a coherent maritime strategy underpinned by a related national strategy to safeguard its maritime interests.