The forecast indicates a 3% increase in global almond production, with exports anticipated to reach 1.1 million metric tons. According to the report, global walnut production will remain stable at 2.7 million metric tons, while exports are expected to see 6% growth, reaching 1.0 million metric tons. No data are yet available for global pistachio production for the 2023/24 season, but production declined significantly in the 2022/23 season, with exports falling 16% to 415,000 metric tons, even as consumption increased by 7% to 808,000 metric tons.

ALMONDS

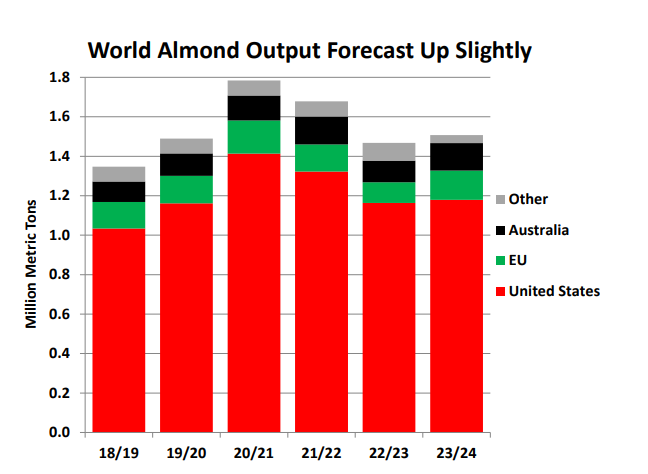

Benefiting from increased production in the United States, Australia and the European Union, global almond production is expected to increase by 3% in the 2023/24 season, rising to 1.5 million metric tons (shelled basis). The report forecasts a 6% increase in worldwide consumption, while global exports are expected to rise by 5% to 1.1 million metric tons as shipments to China and India continue to grow.

Production in the United States is projected to rise by 1% to 1.2 million metric tons as greater bearing acreage and kernel weights more than offset lower yields per tree. Exports are expected to increase by 6% to 900,000 metric tons, driven by strong demand from China and India, with U.S. ending inventories falling sharply from elevated levels last year.

Australia is poised for a remarkable recovery, with a projected 28% rebound to 140,000 metric tons following a challenging harvest last year. This surge in production is expected to drive a 5% increase in exports to 100,000 metric tons. Meanwhile, production in the European Union is forecast to bounce back by 40%, reaching 148,000 metric tons, as Spanish orchards recover from last year’s drought. With increased domestic supplies, imports are expected to dip by 1% to 280,000 metric tons, reflecting steady demand from the food ingredient, snack food and confectionery sectors.

China’s output, hampered by frost damage in the main production area of Xinjiang, is anticipated to plummet from 50,000 metric tons to a mere 5,000 metric tons. To meet consumer demand, imports are expected to surge by almost 25% to reach a record 160,000 metric tons. Meanwhile, India’s imports are forecast to increase by 11% to 170,000 metric tons, in part because of the elimination of retaliatory tariffs on U.S. almonds.

WALNUTS

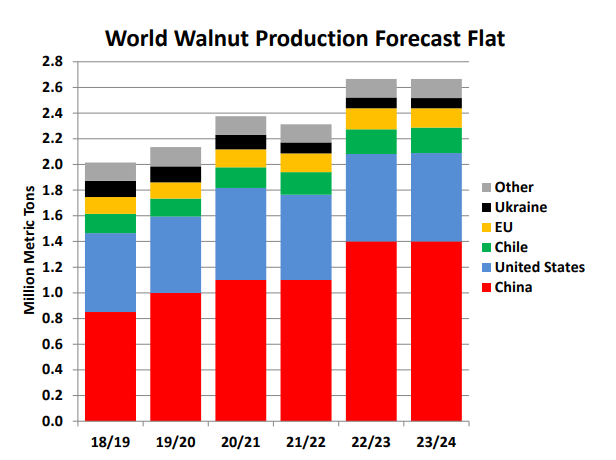

Stability is expected in the 2023/24 season, with global walnut production and consumption both anticipated to remain largely unchanged at 2.7 million metric tons and gains in the United States and Chile offsetting losses in the European Union. The report forecasts a 6% upswing in global exports to reach 1.0 million metric tons, alongside a 4% decline in worldwide ending stocks.

On account of favorable growing conditions and stable acreage, China’s production is expected to remain steady at 1.4 million metric tons. More shipments to the key markets of Turkey and the United Arab Emirates are projected to push exports up by 3% to a record 245,000 metric tons, while imports are expected to stay flat at just 15,000 metric tons.

U.S. production is forecast to slightly grow by 1% as increased yields more than compensate for reduced bearing acreage, which had been expanding since 2000/01. Exports are expected to surge nearly 15% to 450,000 metric tons, with consumption remaining high at 250,000 metric tons. The report also predicts a second consecutive year of declining ending stocks, following the peak observed in the 2021/22 season.

25 Types of Nuts and Seeds You Can Eat

25 Types of Nuts and Seeds You Can Eat

Assuming favorable growing conditions and a moderate increase in bearing acreage, Chilean production is forecast to rise by 3% to a record 198,000 metric tons. Considering that nearly all walnuts produced in Chile are destined for overseas markets, exports are expected to see a similar rise on the back of steady demand from the European Union and Turkey.

Conversely, drought conditions in France are anticipated to cause production in the European Union to decline by 8% to 150,000 metric tons, which alongside greater demand from the snack food and cooking ingredient sectors is expected to drive an 11% increase in imports to 300,000 metric tons.

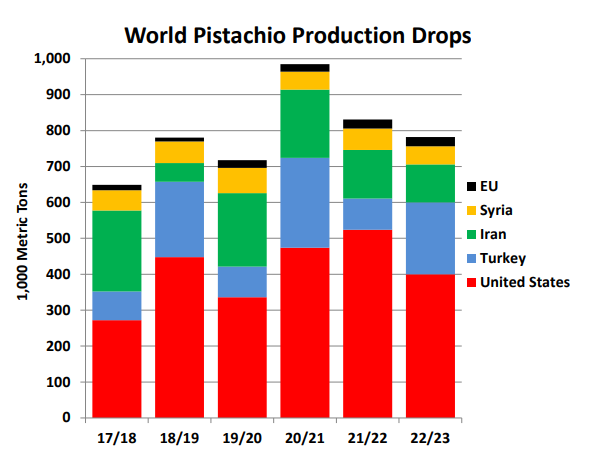

PISTACHIOS

Global pistachio production faced a 6% decline in the 2022/23 season, with total output at 782,000 metric tons, as decreases in key producing nations such as the United States and Iran outweighed gains in Turkey. Correspondingly, exports experienced a significant 16% decrease, settling at 415,000 metric tons, while consumption rebounded by 7% to 808,000 metric tons.

The Iran Pistachio Association reported a third consecutive year of declining pistachio production in the country, which was attributed to a combination of factors including frost and drought. In the 2022/23 season, production plummeted by 21% to 106,000 metric tons, leading to a 40% decline in exports, which fell to 70,000 metric tons.

In the United States, the off-year of the alternate-bearing crop cycle resulted in a 24% decline in production, with output for the 2022/23 season falling to 400,000 metric tons. Weak shipments to China and the European Union contributed to an 11% reduction in pistachio exports from the highs recorded the previous year, with the final export volume being 294,000 metric tons. Lower output and an uptick in consumption resulted in ending stocks plummeting by more than 50%.

By contrast, Turkey, which was in the on-year of its alternate-bearing crop cycle, recorded high yields, with output surging 130% to 200,000 metric tons. Approximately 80% of Turkey’s pistachio production is concentrated in the southeast of the country, where favorable growing conditions benefited trees in the 2022/23 season.

The European Union recorded a 4% increase in pistachio production, with small gains in Italy and Spain leading to a total output of 26,000 metric tons. Meanwhile, imports decreased by 8% to 112,000 metric tons, with the United States maintaining its position as the primary supplier.

Since China’s imposition of retaliatory tariffs on the United States in 2018, Iran has been China’s leading supplier of pistachios. However, with the decrease in production in Iran last season, China’s imports dropped by more than 50% to just 68,000 metric tons.