Last week, BP published its latest Energy Outlook report. Its headline findings should have got much more attention than they did.

BP thinks that global oil demand peaked in 2019. If this is true, it’s a landmark moment in human history.

BP could be terribly wrong. But the important bit isn’t whether the company is correct or not. What’s newsworthy is what this message signals about the energy transition. Even the oil companies have accepted that oil’s future is shrinking, and could fade quickly.

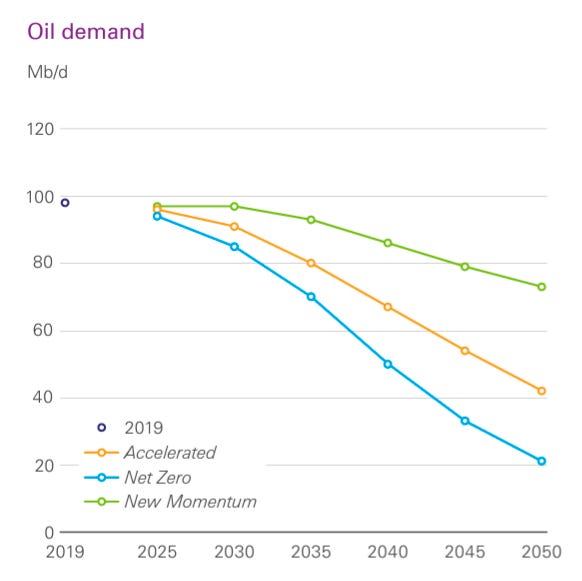

In its report, BP published projections under three scenarios. These are shown in the chart. Its ‘New Mometum’ scenario follows a similar rate of decarbonisation that we’ve seen in recent years – think of it as following the status quo. It then had two more scenarios of increasing climate ambition.

The downward slope of each is different. I’m sure BP hopes we follow the ‘New Momentum’ scenario, while I’ll be pushing for Net Zero. What’s consistent is that in every scenario, global oil demand peaked in 2019.

People have questioned the legitimacy of these projections. Why listen to an oil company about the oil markets? Fair point. But in this case, it would be going against its own interests. If BP was predicting a big oil boon then I’d be skeptical. But it’s the opposite: BP is telling its shareholders that its main product is past its best. It’s downhill from here.

This is about peak oil demand, not supply

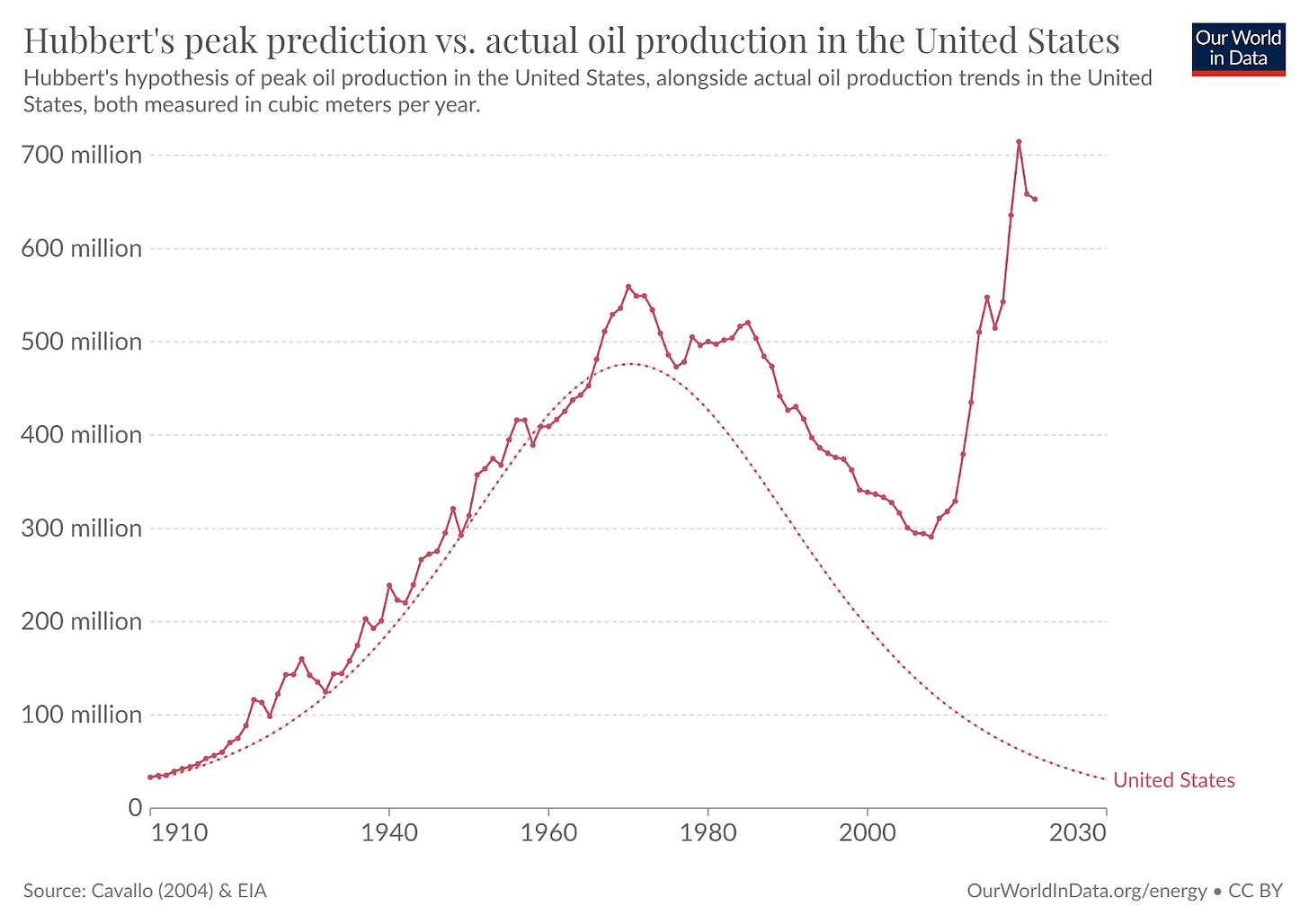

You’re probably thinking “Oh god, not another peak oil prediction”. We’ve been here before. There is a long trail of people predicting ‘peak oil’, and they always turned out to be wrong.

But this is different. Previous predictions were about peak oil supply. This is about peak oil demand. People always feared that we were going to run out of oil. These fears never came true because they consistently underestimated how good we were at finding new oil reserves. The more oil we needed, the more oil we managed to find.

Take the ‘Hubbert Curve’ for peak oil in the United States. It’s shown in the chart below: Hubbert thought that US oil production would follow a classic inverted-U shape. It was a pretty good match until the early 2000s. Then the US got into fracking, opening up massive new resources to tap into.

These new projections are not like the “when will we run out of oil” debate. No, we know we have far too much oil: we need to leave most of it in the ground if we’re to stand a chance of meeting our climate targets. These projections are about oil demand, which is a very different calculation to make.

Why will oil demand fall?

Why does BP think that oil demand is falling?

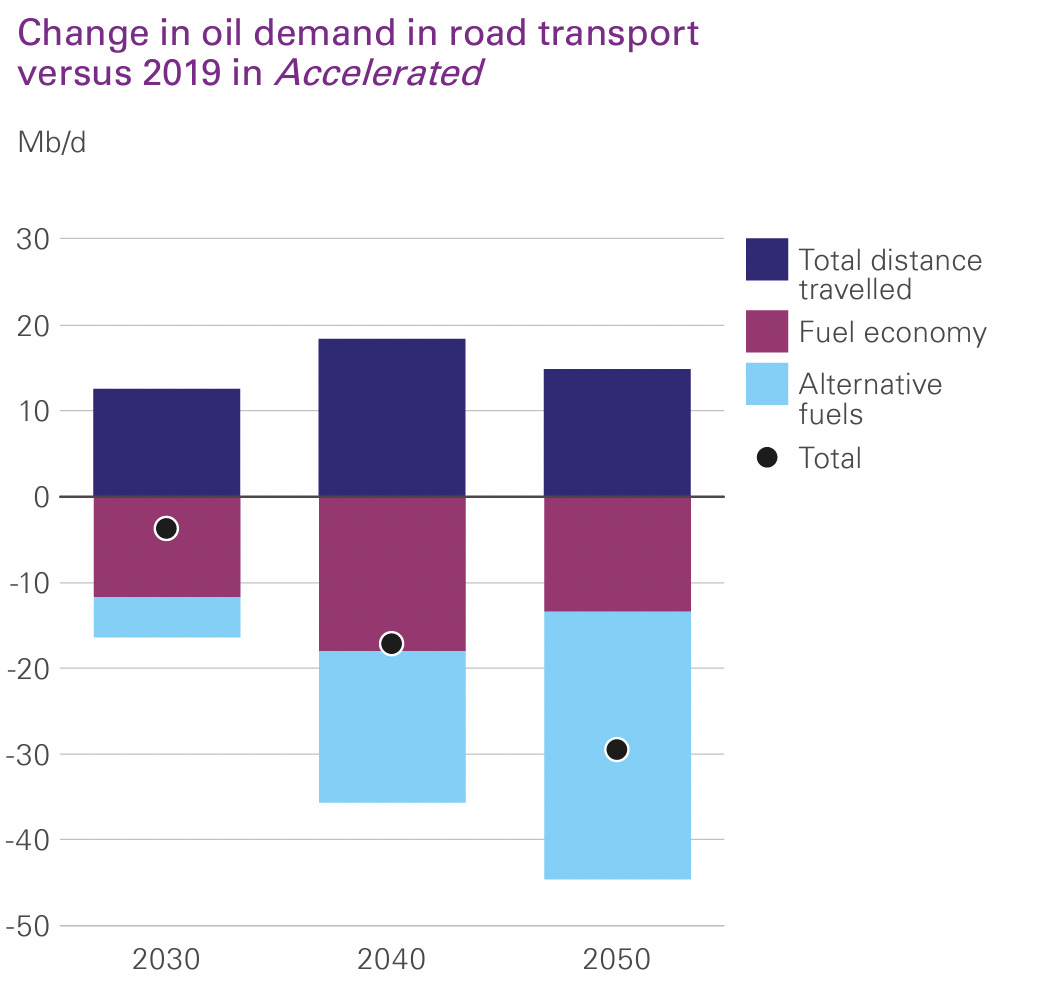

The single biggest driver is road transport. BP expects the world to drive more as people in low-to-middle-income countries get a car, and increase the number of miles they’re driving.

This increase in mileage is offset by two things: an increasingly efficient fleet of cars, and a switch to electric vehicles. BP expects improved efficiency to play a bigger role in the next decade before electrification takes over and dictates the change in oil demand.

FUEL SUPPLY PLACED AT RISK- South Africa

FUEL SUPPLY PLACED AT RISK- South Africa

I think BP will have underestimated the speed of the move to electric cars because almost everyone does. But even then, it is sending a strong signal to the world. Oil is on is in decline, and soon the era of the gas car will be over.