The year 2021 has ended positively for South Africa's agricultural sector.

Farmers experienced a unique season characterized by bumper yields, and higher agricultural commodity prices, particularly in the grains and oilseeds industries. Improved farmers' incomes have boosted spending on agricultural equipment. On the downside, the unrest and looting in July were disruptive, but the cooperation amongst agricultural and logistics role-players ensured a continuous flow of agricultural exports. The primary agriculture sector could show positive growth in 2021,building from an excellent year of 13,4% year-on-year growth in 2020. Going into 2022, the early indicators about the agricultural growth prospects are positive.

Introduction

The year 2021 can be characterized as one of the rarest yet possibly most beneficial for South African farmers, particularly in the grains and oilseeds. The year combined ample crop harvest with higher prices, thus boosting farmers' incomes. Ordinarily, a year of large harvests tends to lead to lower commodities prices, and farmers’ profits are squeezed. But for 2020 and 2021, commodity prices have remained elevated, both in South Africa and globally.

The growing demand for agricultural products, specifically oilseeds in China and India, combined with lower palm oil production in parts of Asia and a poor harvest in South America, were among the key reasons for higher global agricultural commodity prices.As an integral part of the global agriculture ecosystem, South Africa was influenced by the global price trends, mirrored in the domestic prices.

The farmers who benefited from this windfall saw their finances improve and began spending on agricultural equipment, amongst other things. For example, South Africa's total tractor sales for the first eleven months of this year reached 6 980 units, up by 25% year-on-year. The combine harvester sales increased by 38% over the same period, with 250 units sold. Notably, 2020 was also a good year in South Africa's agricultural machinery sales, so surpassing it means we are witnessing good momentum. In 2020, the tractor sales amounted to 5 738 units, up by 9% from 2019. The combine harvester sales increased by 29% to reach 184 units sold in 2020.

Production conditions

The season in 2021 began on a positive footing, with summer crop plantings being completed over an increased area compared with the previous year and benefiting from higher rainfall. The estimates of ample harvest materialized, not only for summer grains and oilseeds but also for the horticulture industry.

Unsurprisingly, South Africa's 2020/21 summer grains and oilseeds harvests were ample, with a sterling performance in particular crops such as soybeans and maize. For example, maize and soybeans saw production reach 16,2 and 1,9 million tonnes, respectively. This is the second-largest harvest in maize and a record harvest in soybeans. Other field crops also generated large yields in 2020/21 compared with the previous year.

Within the horticulture subsector, the South African Wine Industry Information and Systems forecast the 2021 wine grape crop at 1,5 million tonnes, 9% more than the 2020 harvest.[7] Thanks to a good harvest, the Citrus Growers' Association reported a record export of 162 million cartons (each weighing five kilograms) in 2021, up by 19 million from 2020. A notable 9% annual increase in apple and pear exports was also due to a large domestic harvest.

Logistics and trade challenges

The country experienced some challenging moments this year, such as the July 2021 unrest in KwaZulu-Natal and Gauteng that impacted the main trade logistic corridors (i.e. the N3 and N2 highways), increased theft of rail infrastructure, followed by a cyber-attack at Transnet, which briefly affected the movement of goods out of South Africa. For the agriculture and food and beverages sector, which is export-oriented, the unrest happened at particularly crucial times as it was at the height of citrus exports. But the coordination between organized agribusiness and agriculture, Transnet, and various operating ports and truckers' groups forged since the July unrests has proved to be a success.

Perspectives on AGRICULTURE’s PERFORMANCE in Q3 of 2021

Perspectives on AGRICULTURE’s PERFORMANCE in Q3 of 2021

Through meetings organized by Business Unity South Africa (BUSA), the regular interactions amongst these groups have been a pivotal platform to share information about various glitches encountered in the logistics and ease the flow of information to parties that can assist. The logistical challenges have had financial implications, but the coordination has ensured a flow of products and export earnings. This is not a unique experience for the agricultural sector; it also applies to parts of the mining and manufacturing industry.

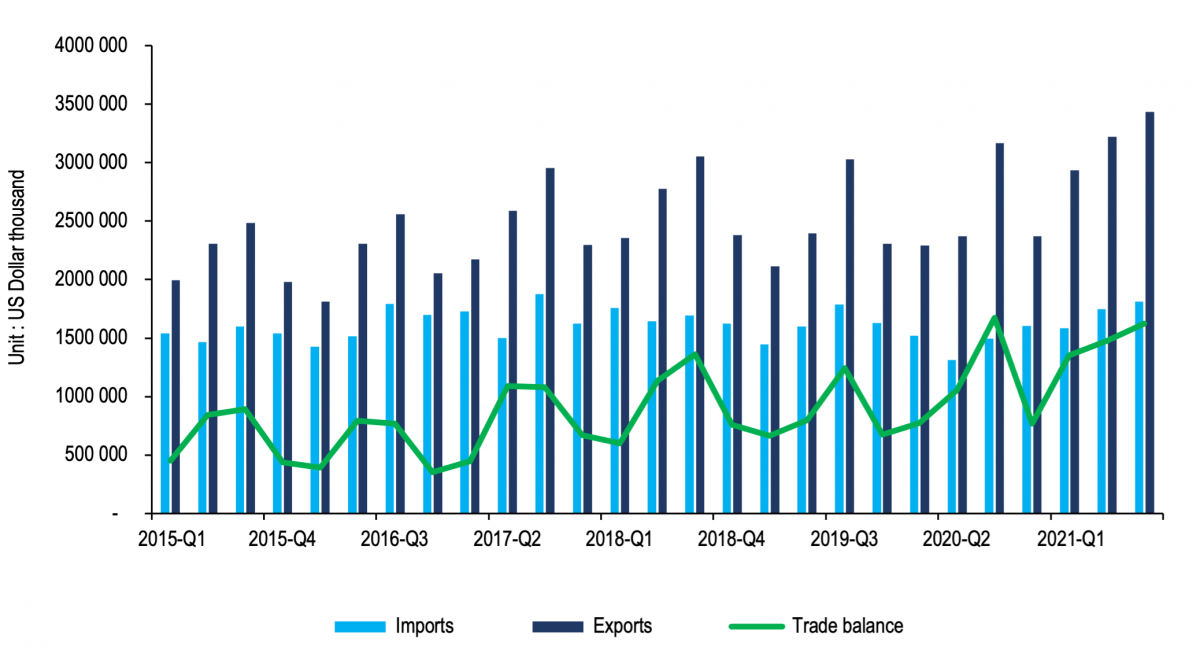

This successful cooperation ensured that South Africa's agriculture, food, and beverages exports for the first three quarters of 2021 reach US$9,6 billion, up 23% compared with the same period in 2020 (see Figure 1). The top exportable products were citrus, maize, wine, apples and pears, nuts, sugar, fruit juices, and wool, amongst other products. There are still ample agricultural and beverages exports ongoing since the start of the final quarter of this year. Hence, we are inclined to believe that South Africa could surpass 2020's agriculture exports of US$10,2 billion, which was the second-highest on record, and could even pass the record exports of 2018, which was US$10,6 billion. It is possible that agriculture, food and beverages exports could hit a record US$11 billion mark this year.

Figure 1: South Africa's agricultural trade

Source: Trade Map and Agbiz Research

Significantly, the Covid-19 pandemic has not changed the orientation of South Africa's agricultural export markets. While many economies have performed poorly because of the pandemic, the volume of agricultural exports has maintained a similar pattern to previous years. For example, in this year's third quarter, the African continent and Asia were the largest markets for South Africa's agricultural exports, accounting for 35% and 33% in value terms, respectively. The European Union was the third-largest market, taking up 23% of South Africa's agricultural exports. The balance of 9% value constitutes the Americas and other regions of the world.

In the last quarter of the year, the Agricultural Business Chamber of South Africa (Agbiz) convened regional meetings of agribusiness to discuss a range of agriculture policy issues. The two major running themes in all the engagements were the need to expand South Africa's agricultural export markets beyond the current reach, along with concerns about logistical interruptions. China, Japan, India, Saudi Arabia, and Bangladesh are some markets where South African agribusiness is interested in expanding its presence. This is because of the growing population and generally better economic conditions that support the demand for high-value agriculture, food, and beverages products.

Employment conditions

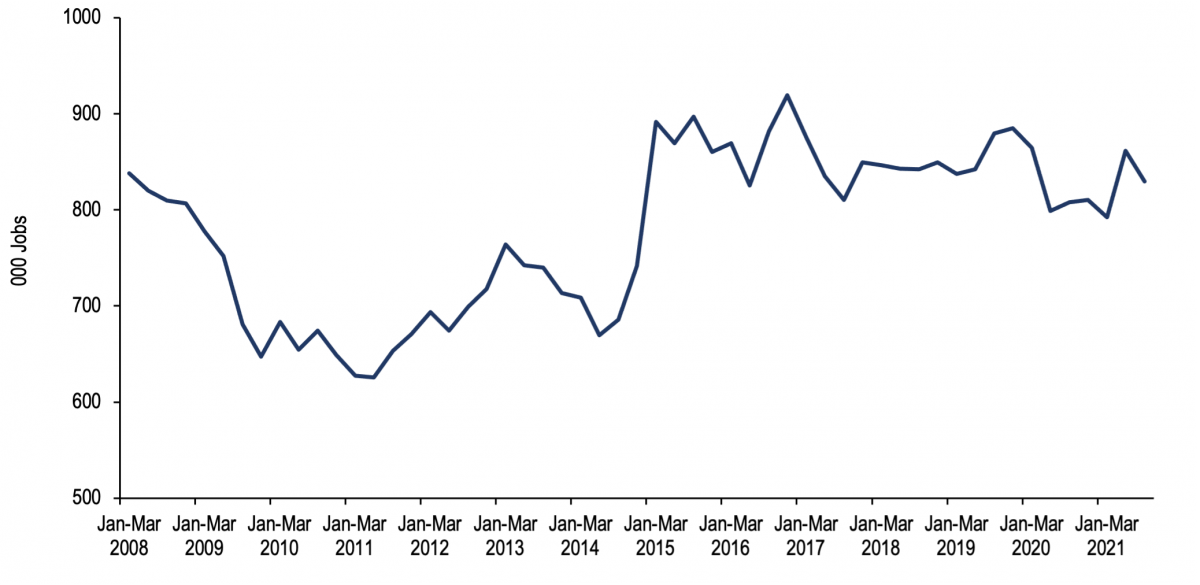

The robust agricultural activity this year has also ensured improved employment activity. In the third quarter of 2021, agricultural employment increased by 3% y/y to 829 000.[8] The third quarter of each year is typically not a busy period for agriculture; hence employment is down 4% from the second quarter – a busy harvesting period for field crops, with seasonal employment opportunities. Still, this is well above the long-term agricultural employment of 780 000, which shows that the sector has contributed positively to the labour market (see Figure 2).

Exhibit 2: South Africa's agriculture employment

Source: Stats SA and Agbiz Research

Notably, two of the provinces, Western and Northern Cape, which saw a significant drop in employment in the previous quarters partly due to the temporary ban on alcohol sales, saw a recovery by this year's third quarter. This speaks to a rebuilding effort that producer organizations have undertaken over the past few months. One hopes that this rebuilding momentum is not interrupted in the wake of the Omicron variant of Covid-19.

Still, a critical development on the agriculture labour market at the start of the year was the 16,1% increase in the farm minimum wage to R21,69 per hour with effect from 1 March 2021. At the time of its publication, various commodity groups indicated that the increase in the minimum wage would cause a further squeeze on cash flow and negatively influence hiring decisions. But, the actual effects of the current minimum wage increase on jobs will only be apparent after a time lag.

The favourable agricultural conditions, combined with higher commodity prices, have also improved the farmers' financial conditions and, thus, temporarily eased the pressure of minimum wage increase.

Sentiment in the sector

The robust activity also boosted sentiment in the sector. After a slight retreat to 67 in the third quarter, the Agbiz/IDC Agribusiness Confidence Index (ACI) recovered to 74 points in the final quarter of this year.[9] This is the second-highest level since the inception of the ACI in 2001 (the second quarter of this year had the record level at 75 points). A level above the neutral 50-point mark implies that agribusinesses are optimistic about operating conditions in the country. Essentially, 2021 was a challenging yet positive year for South Africa's agricultural sector.

Conclusion

The quarterly data[10] in terms of growth in the sector tend to be volatile and might not present the most accurate picture; hence we focus on an annual figure. In this regard, the Bureau for Food and Agricultural Policy (BFAP) forecasts South Africa's agricultural growth for the year at 7,6% y/y (from the strong growth of 13,4% y/y in 2020).[11] Admittedly, the significantly weaker growth in the year's third quarter[12] suggests that agriculture could grow by a much softer value in 2021. Still, this will likely be a positive expansion.

Looking ahead, the early indicators to 2022 are equally positive about the agricultural growth prospects. Farmers have lifted the area plantings for summer crops, the rainfall outlook is favourable, and the commodity prices remain elevated. There are unique price-driving factors for crops going into 2022, but broadly, the growing demand for grains and oilseeds in China, poor crop yields in South America in the 2020/21 production season, and higher shipping costs remain the primary price drivers. These high commodity prices will partly offset farmers' input costs of the 2021/22 production season.