Charted: Top Destinations for Africa’s Exports (1995-2020)

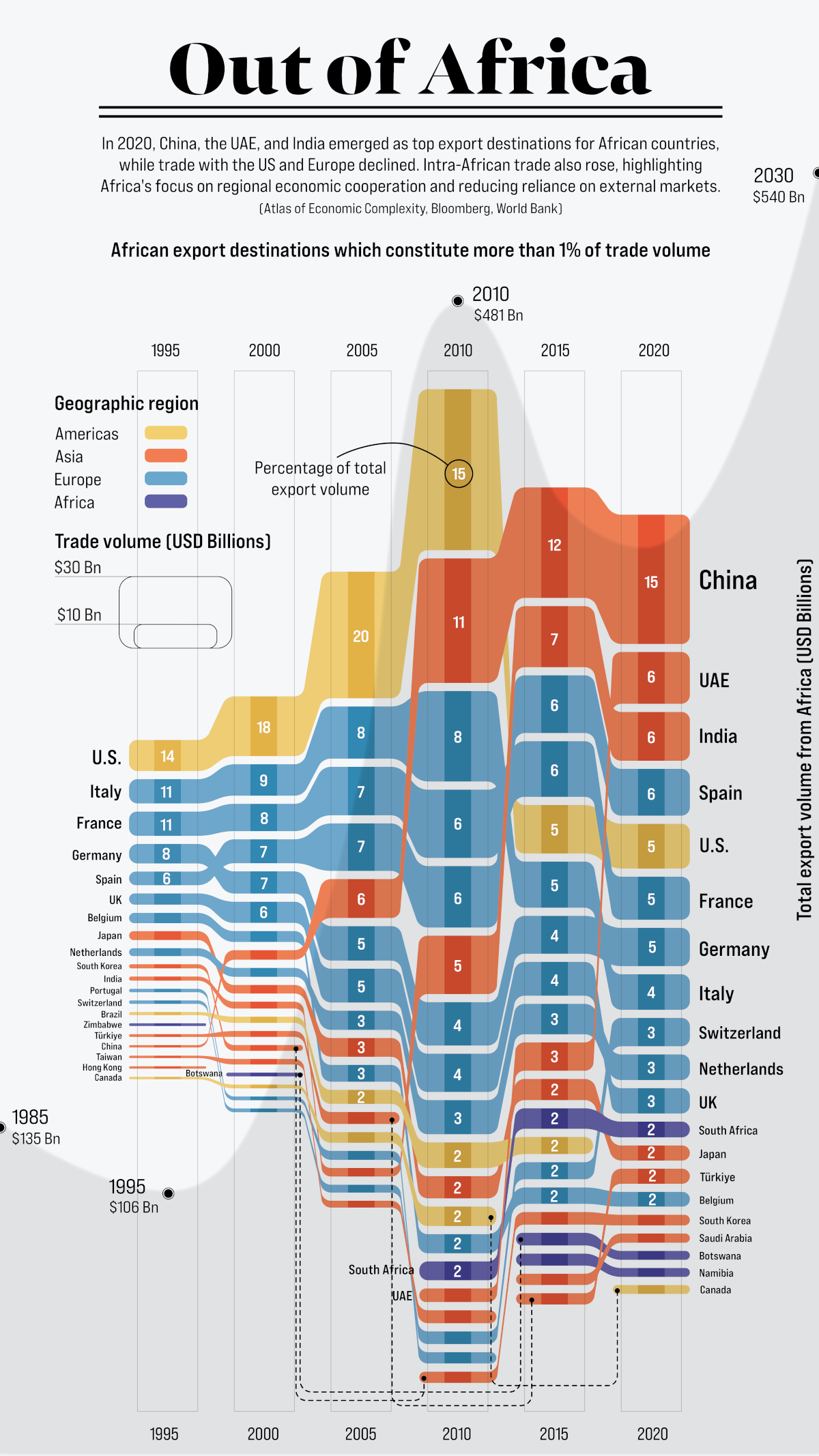

Just under 30 years ago, exports originating from countries in Africa sat at $106 billion annually, primarily going to nations in the West. By 2020, Africa’s exports had more than tripled, but now with Asia as the primary destination.

The world’s second-largest continent, much of the value of Africa’s exports are concentrated in natural resources like petroleum, gold, diamonds, natural gas, and coal. Agricultural commodities like tea, coffee, and cotton also find large markets overseas.

Which countries are the top destinations for Africa’s exports?

This graphic from Sebastian Gräff uses data from Harvard University’s Atlas of Economic Complexity, the World Bank, and Bloomberg to track total exports from African countries over the years. Countries receiving a 1% or greater share of total exports have been included, and percentages have been rounded.

Tracking Africa’s Exports Between 1995 and 2005

The U.S. was the top destination for African goods for many years, led by the country’s demand for petroleum products. At its peak in 2005, the U.S. received one-fifth of the continent’s exports, valued at $55 billion.

Here’s a look at all the countries that had a 1% or greater share of Africa’s total export value at some point from 1995 to 2005.

Western European countries—Italy, France, Spain, Germany, Belgium and the UK—also accounted for a significant share of Africa’s exports throughout this time period. Part of this was due to century-old relationships and colonial legacies, but trade was also encouraged by initiatives like the 1976 Lomé Convention, which gave products from developing African countries (particularly former colonies) duty-free access to European markets in exchange for developmental aid.

During the mid-2000s, China also started to take up a growing share of the continent’s exports, as its rapid industrialization led to skyrocketing demand for commodities such as oil, iron ore, and copper—all key African exports.

Asia’s Growing Export Share Between 2010 and 2020

By the year 2010, as African exports topped the $481 billion per year mark, the global market was rapidly starting to change.

For starters, thanks to a considerable increase in domestic oil and natural gas production, the United States began cutting back on African petroleum imports.

At the same time, China had been actively seeking resources and investment opportunities in the developing world as part of its greater geopolitical strategy. By 2015, it had surpassed the U.S. as Africa’s primary export destination, marking a shift in the continent’s trade dynamics.

Here’s a look at all the countries with a 1% or greater share of Africa’s total export value from 2010 to 2020.

China was joined in the top three ranks by India and the UAE, who were also experiencing rapid industrialization and growing demand for African commodities. In 2020, nearly 40% of Africa’s exports found a market in Asia, led by China and India’s significant trade volumes.

In comparison, Western Europe had started relinquish both its share and value of African goods imported. Alongside growing demand from developing countries, there became greater diversification in African export markets, with countries from Asia (Malaysia, Pakistan), Eastern Europe (Poland, Russia), and within Africa (the Democratic Republic of the Congo, Uganda), accounting for growing shares of African exports.

The Future of the African Export Market

Though Africa’s largest export markets are outside the continent for now, there is vast untapped potential for inter-regional exports, which stood at only 15% of total export value in 2020.

There is movement to expand on this trade, with the African Continental Free Trade Area (AfCFTA) established in 2018 to reduce trade barriers between African countries. According to UN estimates, it has the potential to create a $3 trillion market within the continent alone.

With one of the fastest-growing regional populations, the African continent’s economic stakes have never been higher. So who will end up dominating Africa’s trade landscape in the decades to come?