Heleen Viljoen - Technical Article - Second Runner up - 2022

The importance of maize exports for our local commodity markets

In the eyes of food security, both white and yellow maize have immense value, especially for Africa. Traditionally, white maize has been held in low regard in international markets but is quickly being bought up by our sub-Saharan neighbours. The reason for this is that these countries have a colour preference for white maize, which is mainly imported for human consumption.

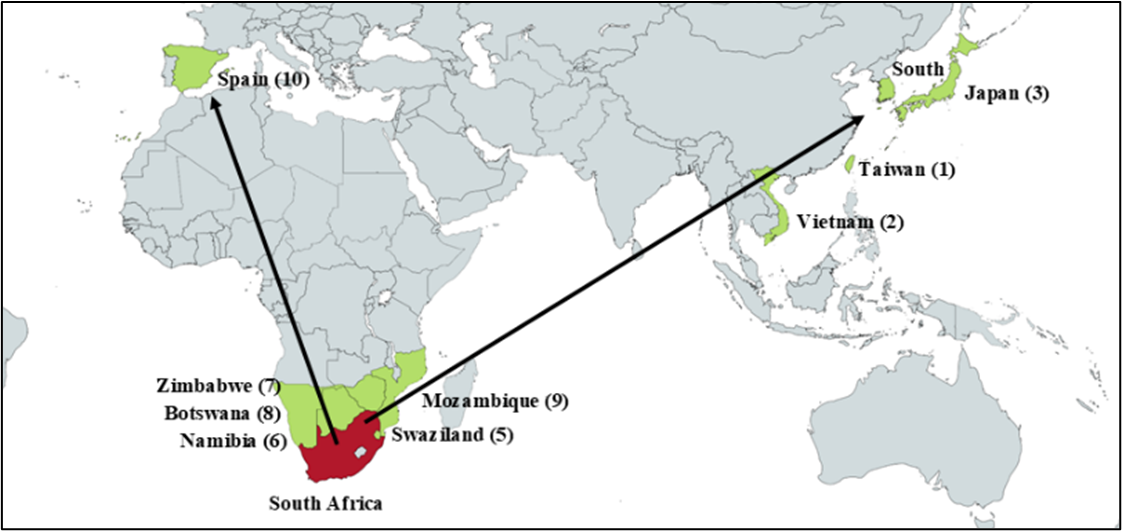

It is important for South Africa to keep an eye on these countries. On a five-year average, 83% of South Africa's white maize is exported to Sub-Saharan Africa. The balance between the imports and exports of these countries is highly dependent on their local production, which determines the final demand for maize. In the case of yellow maize, exports are predominantly to international markets, as can be seen from figure 1.

Figure 1: Top 10 South African yellow maize export destinations (five-year average)

Source: SAGIS

The effect of exports on the local maize market

South Africa is a net exporter or maize. Thus, local maize production is sufficient in satisfying local demand- with an exportable surplus. The ability of South Africa to produce an exportable surplus has a significant impact on local maize prices.

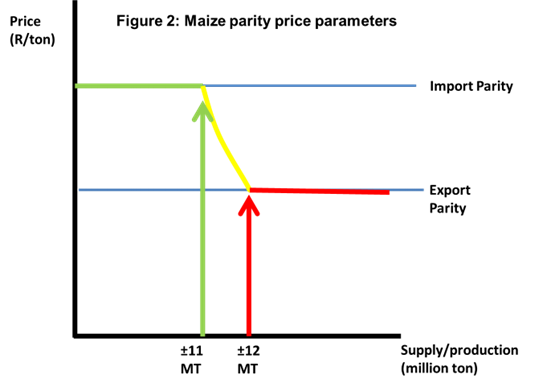

Figure 2 illustrates the import- and export parity parameters that is used to monitor local commodity price movements. Import parity represents a price parameter for the cost incurred if the local supply was insufficient, and the product would need to be imported. In the context of South Africa, locally, on average 11million tons of maize is consumed. Thus, if local production was lower than 11million tons, local prices would move closer to the import parity parameter as maize would need to imported at international prices to satisfy the local demand. If local production is large enough to meet local demand, the remaining surplus can be exported. When local production is left with an exportable surplus, local prices tend to move closer to the export parity parameter. The export parity parameter in essence indicates how competitively local maize is priced compared to the international market.

Figure 2 illustrates the import- and export parity parameters that is used to monitor local commodity price movements. Import parity represents a price parameter for the cost incurred if the local supply was insufficient, and the product would need to be imported. In the context of South Africa, locally, on average 11million tons of maize is consumed. Thus, if local production was lower than 11million tons, local prices would move closer to the import parity parameter as maize would need to imported at international prices to satisfy the local demand. If local production is large enough to meet local demand, the remaining surplus can be exported. When local production is left with an exportable surplus, local prices tend to move closer to the export parity parameter. The export parity parameter in essence indicates how competitively local maize is priced compared to the international market.

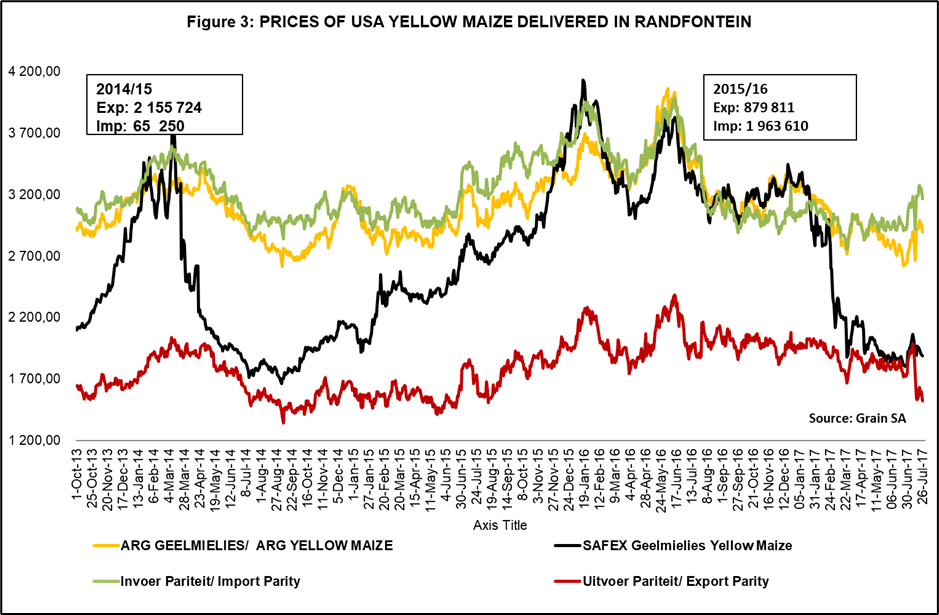

Figure 3 illustrates how local maize prices react to local supply- and demand, ultimately trending between the parity parameters. In the 2014/2015 production season, South Africa produced enough maize to be able to export. For the season a large amount of maize was exported, and prices moved closer to export parity. In the following season, South African maize production was subjected to severe drought and production was significantly lower. Thus, in the 2015/2016 production season maize was imported. Imports exceeded exports and local prices trended closer to import parity.

For the 2022 production season, South Africa is estimated to produce 7.79million tons of white maize and 7.54million tons of yellow maize. Thus, as a collective South Africa is estimated to produce 15.33million tons of maize, exceeding local demand. South Africa’s ability to export helps relieve inland supply build-up pressure, keeping local prices competitive in the international market.

In conclusion

South Africa's grain markets function in a free market economy. This therefore means that market forces, along with supply and demand, determine prices at the end of the day. When looking at supply and demand, imports, and especially for maize, exports are seen as determining factors. South Africa’s ability to export internationally plays a key role in local price determination.

Heleen Viljoen

I grew up in Durbanville in a household where the finance world had a strong influence. From there I went on to study Agricultural Economics at the University of the Free State, where my love for agriculture grew. I am currently a Junior economist at Grain SA where I get to combine both my love for agriculture with economics. I am also part-time busy with my Master’s degree, with a focus on the functioning of the South African commodity markets.

I grew up in Durbanville in a household where the finance world had a strong influence. From there I went on to study Agricultural Economics at the University of the Free State, where my love for agriculture grew. I am currently a Junior economist at Grain SA where I get to combine both my love for agriculture with economics. I am also part-time busy with my Master’s degree, with a focus on the functioning of the South African commodity markets.