Lithium is a key component of electric vehicle (and other) batteries. You might have heard of ‘lithium-ion’ batteries. They are very energy-dense, and have achieved massive improvements in their performance. In a previous post I looked at the plunging cost of lithium batteries; they have fallen by more than 98% since the early 1990s.1

To move to electric transport, lithium is one of our best shots. That’s why it’s so important.

We can get lithium from two sources.

First, it can be extracted from hard rocks in the ground, just like we imagine in traditional mines.

Second, it can be extracted from brine – that is, water rich in lithium salt. To get this lithium, salty groundwater has to be pumped to the surface and left to sit in large ponds for months on the end. When most of the water is evaporated away, lithium can be extracted.

We keep discovering more lithium, and we get better at mining it

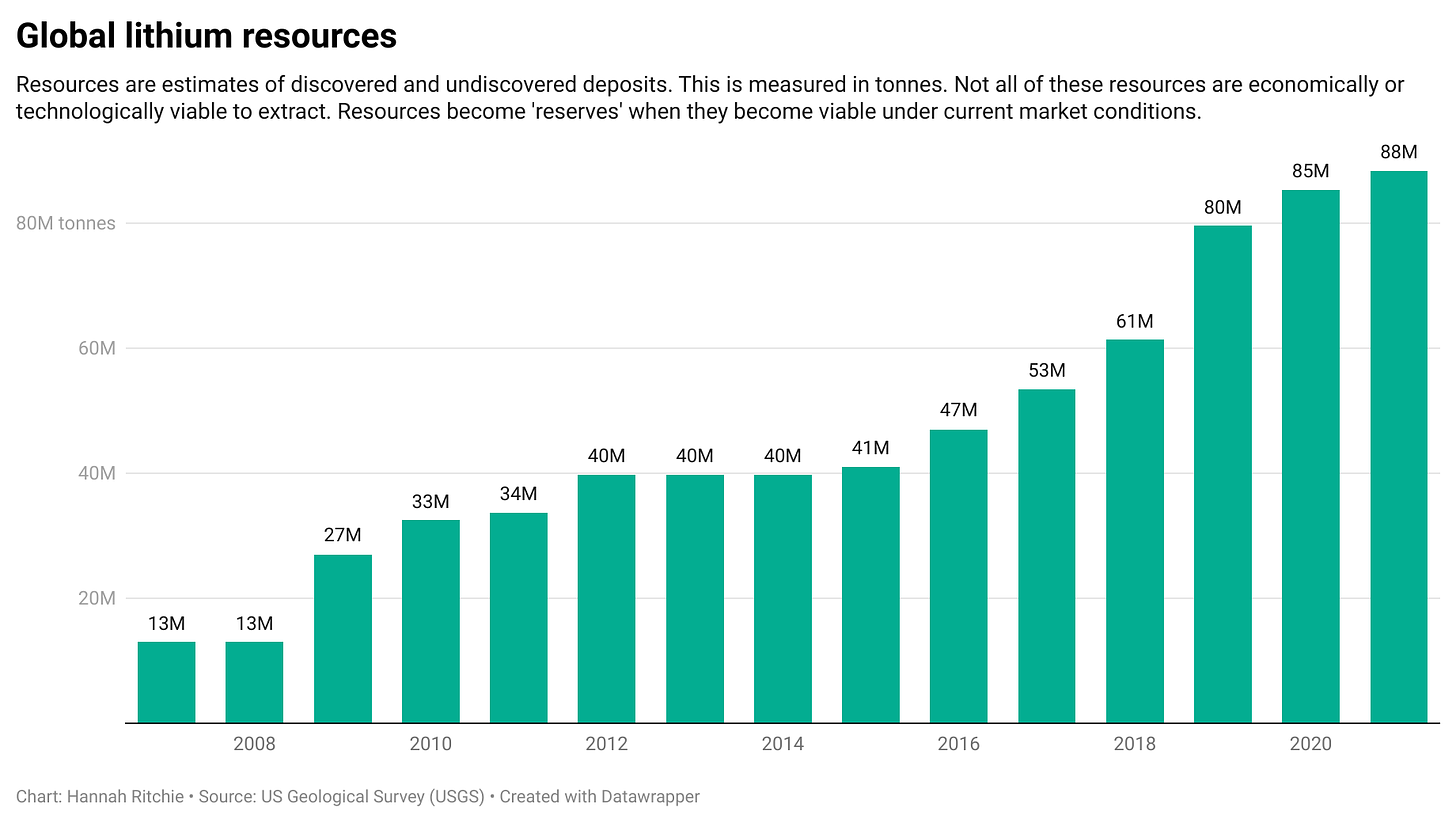

How much lithium does the world have? We don’t really know for sure.

What we can estimate are ‘resources’: a ‘best guess’ of deposits that we’ve discovered and studied, and some that we think are there but are undiscovered.

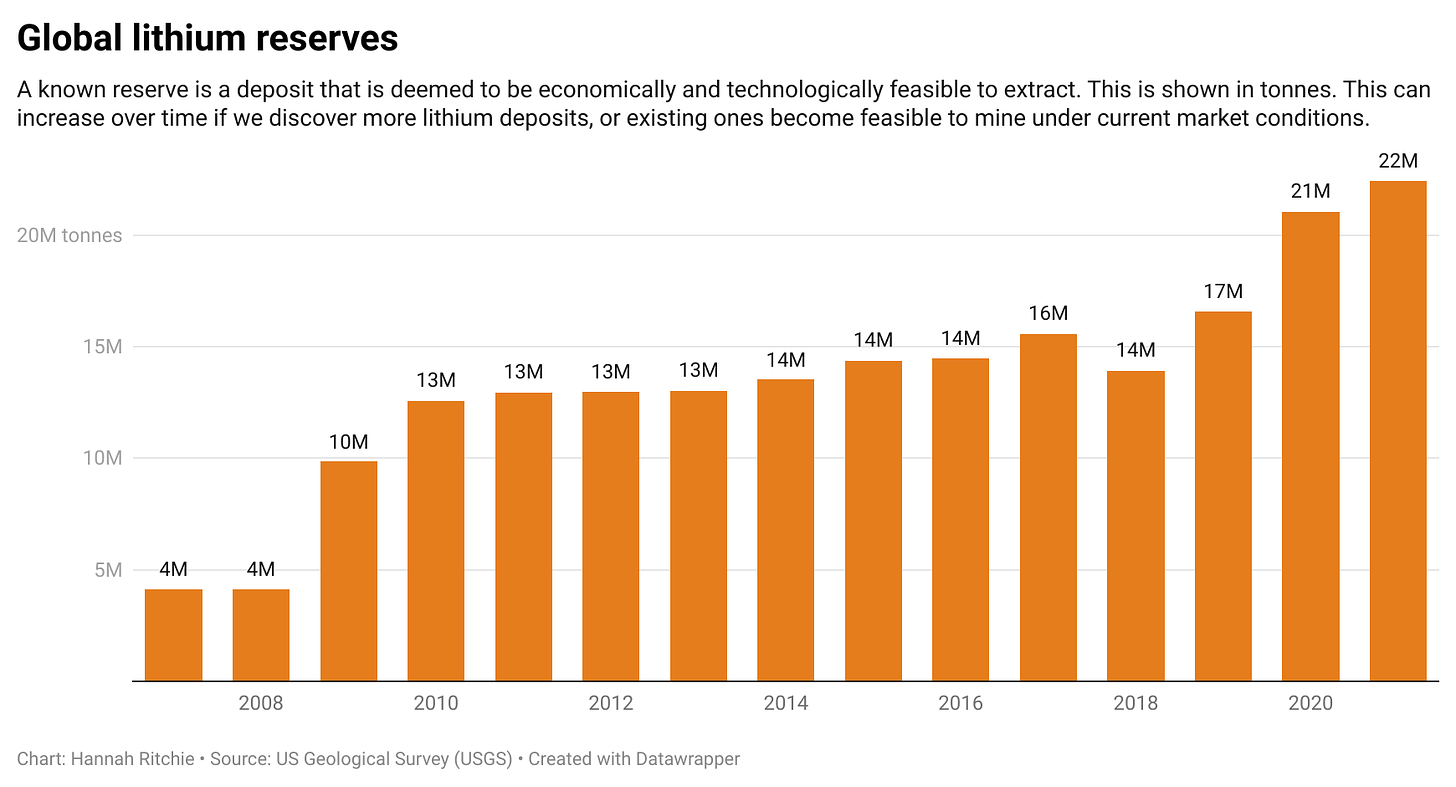

Not all of these deposits are feasible to extract with our current technologies, or they are too expensive. The amount of lithium that we know we can technologically and economically mine are called ‘reserves’.

In 2021, it’s estimated that the world had 88 million tonnes of lithium.2 These are ‘resources’. One-quarter of this – 22 million tonnes – was feasible to extract. These are ‘reserves’.

What’s important about these figures is that they change all the time: we’re always discovering new lithium, and as our technologies and market conditions improve, more of our resources become economical to extract.

You might imagine that a chart of known reserves or resources over time would go down. But it’s the opposite: I’ve charted them below, and you can see them going upward because we're discovering new despoits much faster than we're using them up.3

When we really want something, we get good at finding it.

The world has enough lithium for the electric vehicle transition

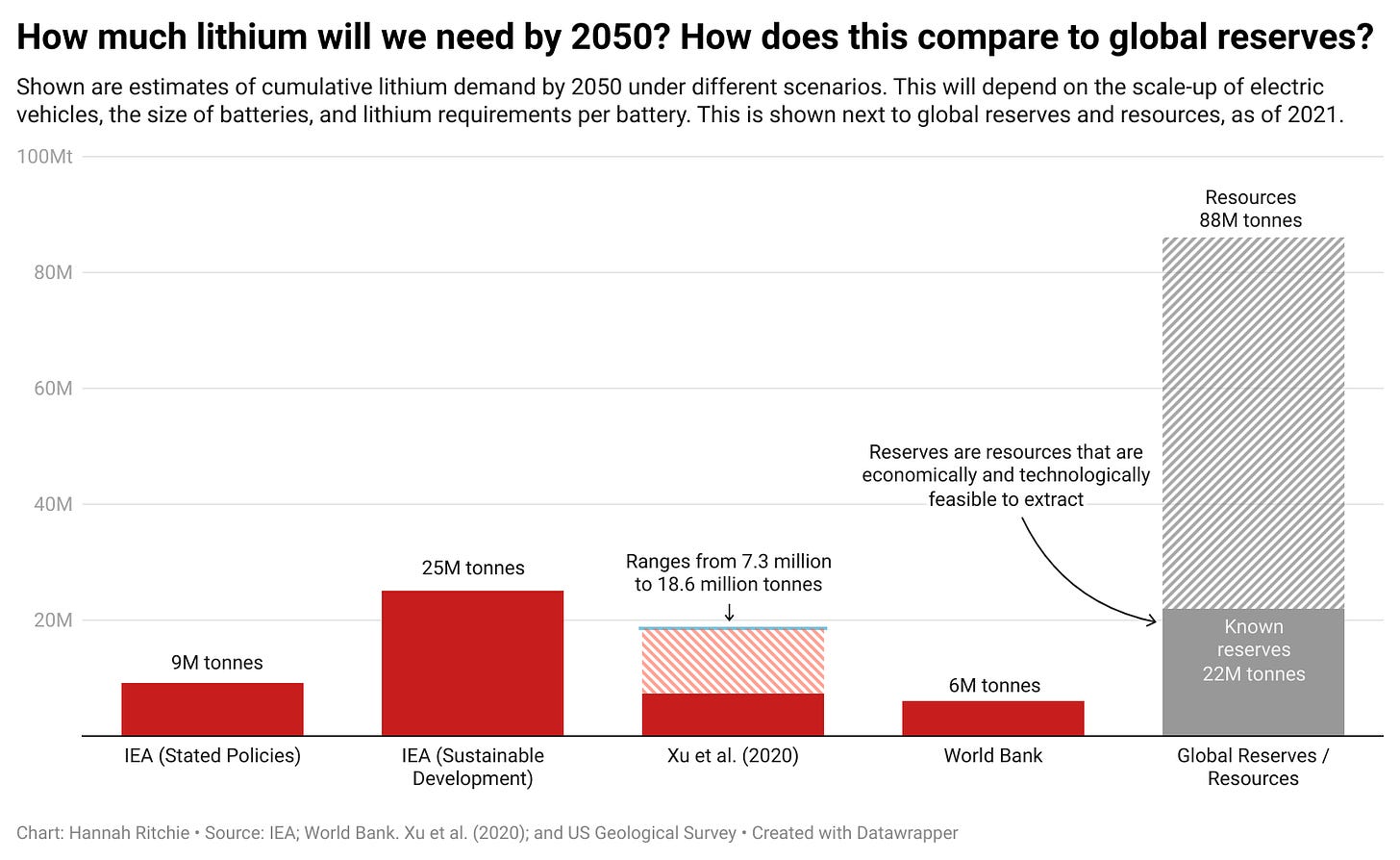

Is 22 million – or 88 million – tonnes of lithium enough? How much do we need to switch from fossil fuel to electric cars?

There is a wide range of estimates, which depend on several factors: how quick and widespread EV adoption will be; the size of batteries; and how much lithium we’ll need per battery.

Let’s compare a range of estimates of the cumulative amount of lithium we’ll need by 2050. These come from several sources: the IEA’s projections based on countries’ stated policies, and its sustainable development pathway which accelerates this transition; estimates from a Nature study by Xu et al. (2020); and a study by the World Bank.4

These are shown in the chart, alongside the world’s current reserves and resources.5

The difference between 6 million, 18 million, or 25 million tonnes seems really large. But I don’t think this wide range is that important. It’s easy to imagine that decades from now, the chemistry of batteries will have changed so much that they will use two, three, or four times less than today. I’m more interested in the overall magnitude of these estimates – that they’re ten to twenty million tonnes (ish)– than the precise figures.

How many electric vehicles are we assuming in these scenarios? We can do a quick sense-check. The average EV currently needs around 8 kilograms of lithium.6 With our current 22 million tonnes of reserves, we’d get 2.8 billion EVs. With our 88 million tonnes of resources, we’d get 11 billion EVs.

Some of the figures in the chart look tight, compared to our reserves. But I don’t think that this is cause for concern. Markets and innovation respond to changes in supply and demand. We will inevitably find more reserves and resources. And, the chemistry of our batteries will change so that we need less lithium per pack.

Can we recycle lithium-ion batteries?

All of our numbers so far assume that demand has to be met through new lithium.

What if we could recycle lithium from batteries at the end of their life? This would be the ideal scenario. If recycling rates were high enough, we could almost completely close the loop on producing new batteries, or at least reduce the need to dig more out of the ground.

Today, less than 1% of lithium is recycled.7 Most of the projections we looked at assume that it stays low. The IEA, for example, assumes that by 2040 just 6% is recycled.

One problem is that recycling lithium is more expensive than mining new stuff. It might not stay this way. This used to be the case with lead-acid batteries: they were rarely recycled but after these markets scaled, almost all of them are today.

A better option is to not only recycle batteries – by grinding them up and extracting the minerals – but by repurposing them at the end of their life. This could be less expensive, but we’ve still to see it working at a commercial scale.

Even if we were to quickly increase recycling or repurposing rates, the demand for new lithium might not change much. At least, not very soon. There just won’t be very much material to recycle. Most EVs are still going to be on their first life by 2040 or 2050. Only later, when many are preparing for their second or third round, that recycling could make a dent in global lithium demand.

We are struggling to produce enough lithium this decade. We urgently need more production capacity.

I’m not that concerned about long-term lithium supplies. But our capacity to produce lithium at the moment is tight, and it’s having an impact on EV prices and supply.

In a previous article, I showed that the price of lithium-ion batteries has fallen by more than 98% since the early 1990s. But, this cost stalled last year, partly due to a rise in lithium prices. Prices are higher because supplies are tight.

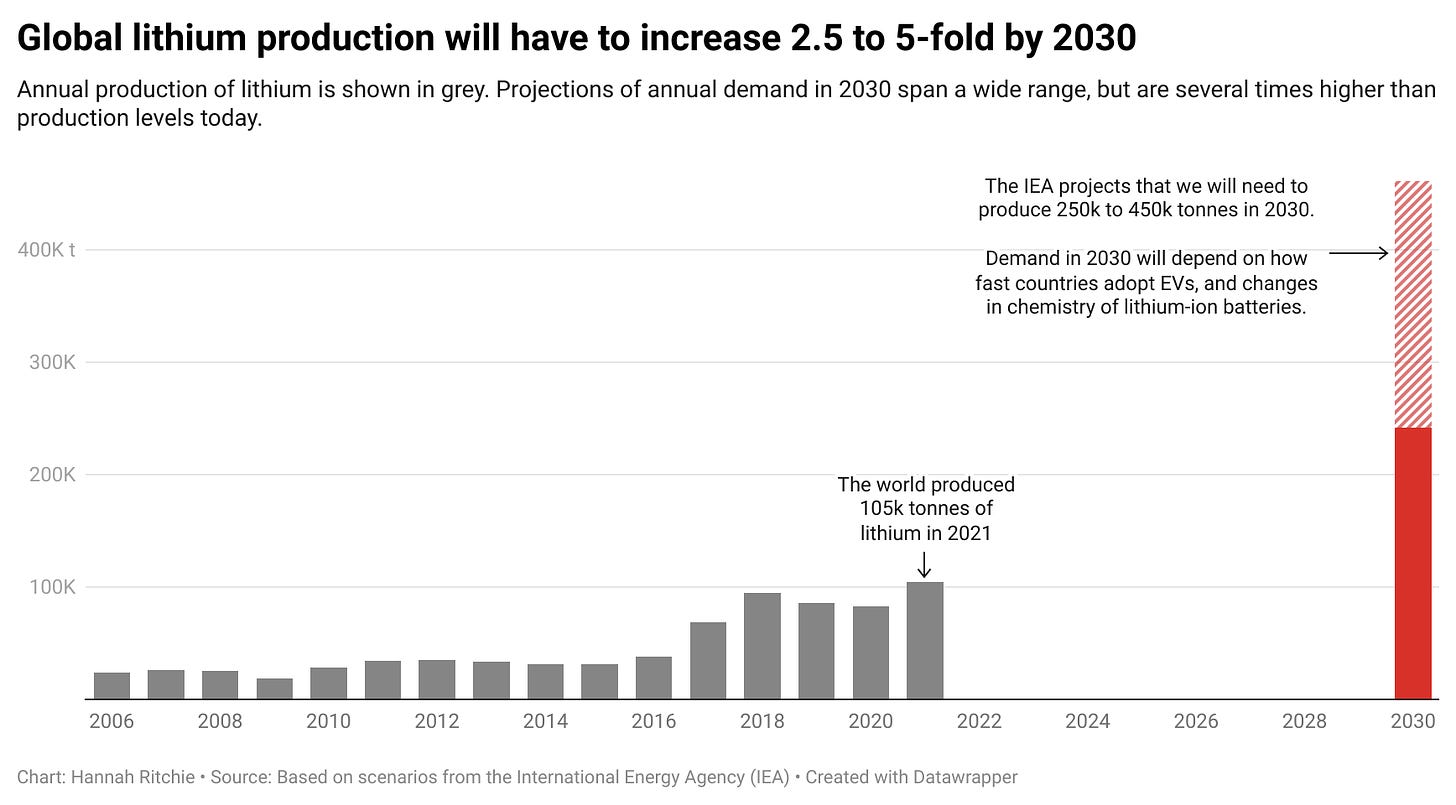

We currently produce around 100,000 tonnes each year. By 2030, the IEA projects that we’ll need 2.5 to 5 times as much: 240,000 to 450,000 tonnes.

If you want to do some quick maths on this, let’s assume an EV needs 8 kilograms of lithium: that tonnage would give us 30 to 60 million new EVs per year.

The world doesn’t currently have the production capacity in mining operations to scale to this level. And, the problem is that the minimum time to build lithium mines is four to five years. They can be even longer – especially the lithium extracted from brine because it takes a long time to pump the saltwater out, before waiting for it to evaporate.

Countries have already invested in some increases in capacity, but we will need much more if we’re to keep up with demand.

This is a short-term challenge, and one that is typical of a fast-moving market. We’re playing catch-up. But, it’s a problem that we can’t afford: it could slow the decline in battery prices, and limit the number of EVs that companies can produce.

If we want to move the EV transition forward, we need to mine more lithium. And we need to do it quickly.

Electric vehicle batteries would have cost as much as a million dollars in the 1990s

Electric vehicle batteries would have cost as much as a million dollars in the 1990s

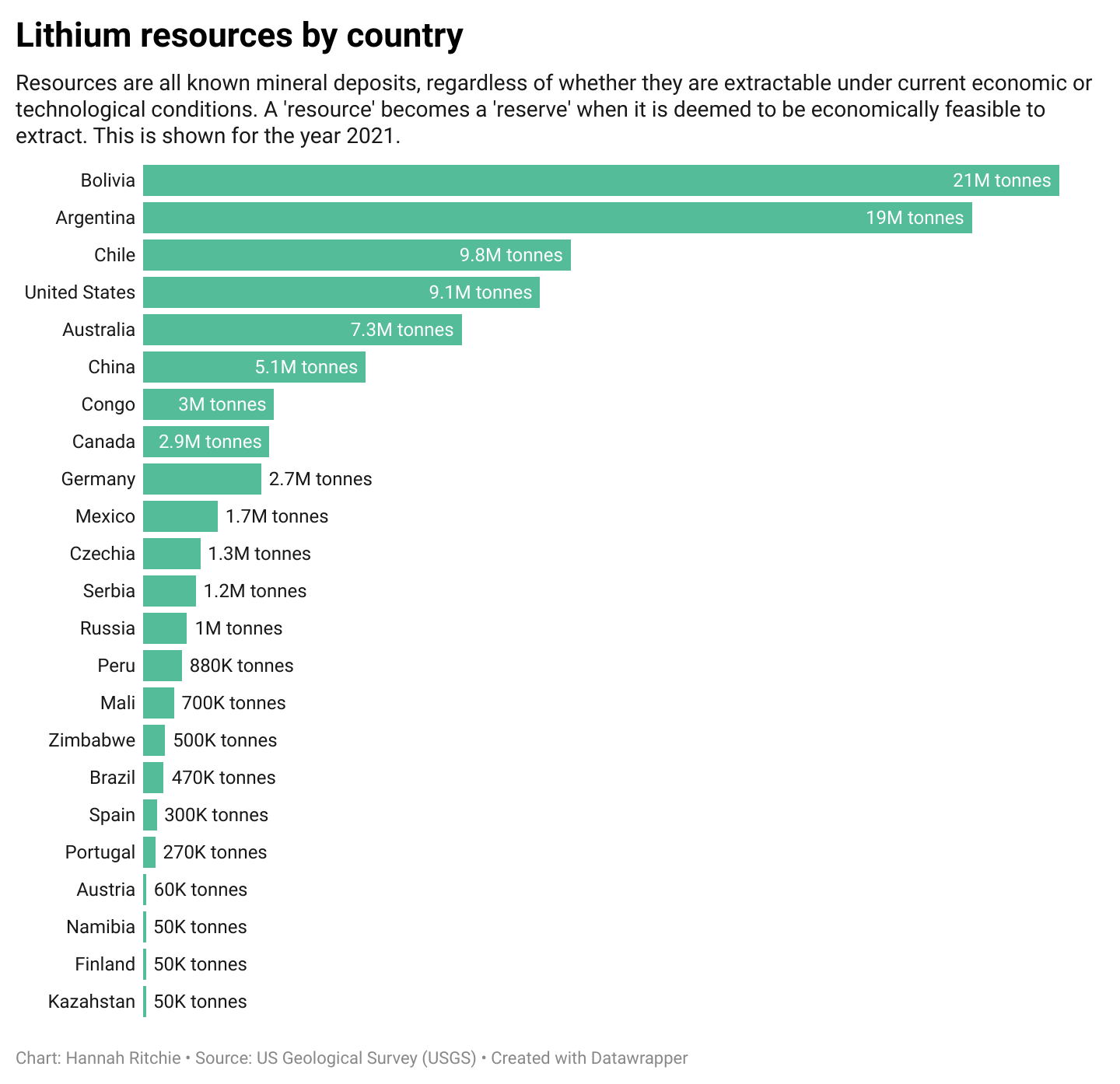

Which countries have lithium?

Where is this lithium going to come from?

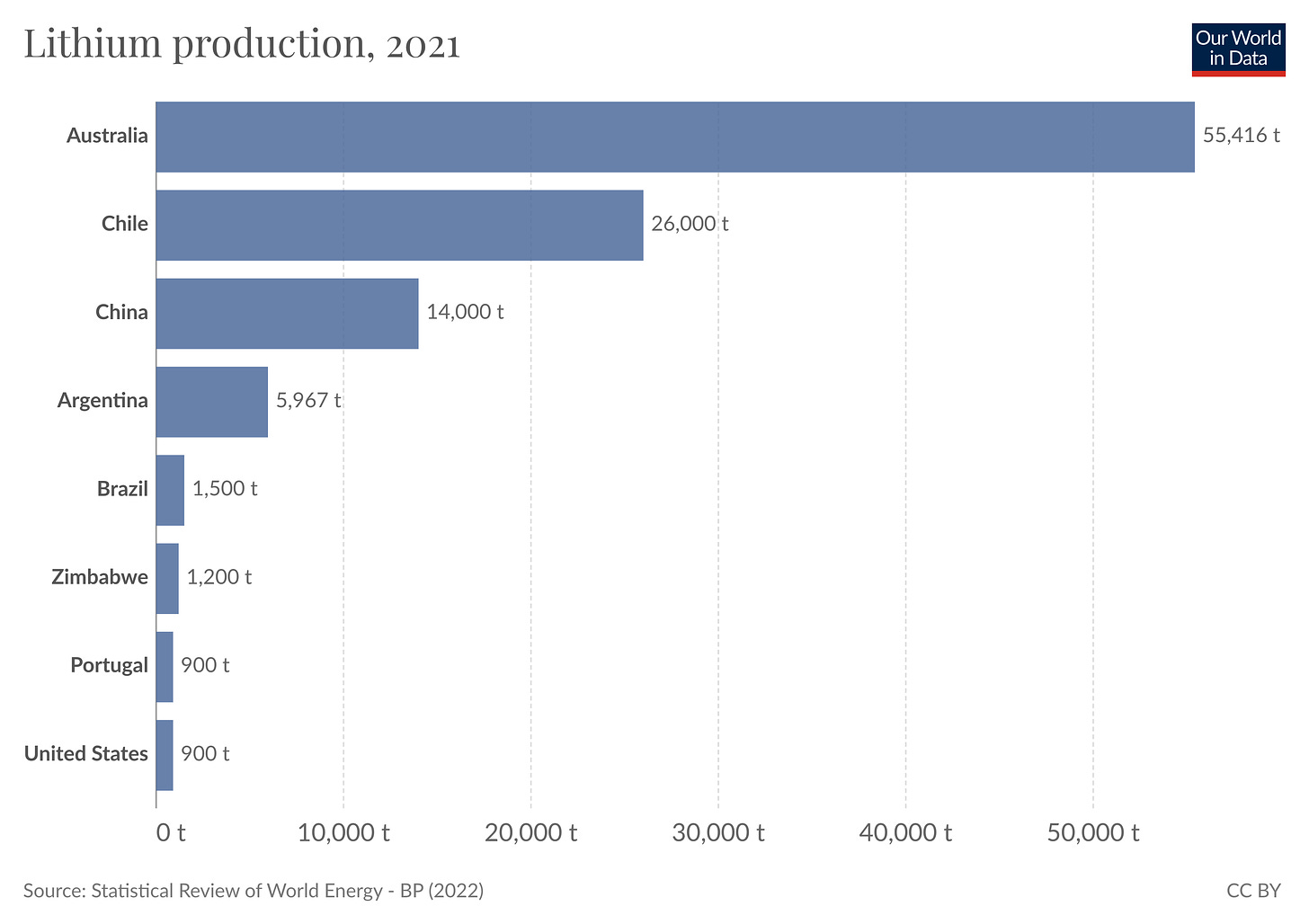

A few countries currently dominate global production. This is shown in the chart. Australia produces more than half of the world’s lithium, followed by Chile, China, Argentina, then a number of small producers.

If the world is going to produce more lithium in the next five years, it’s going to come from a small number of countries: Australia, Chile, China, and Argentina.

In the longer term, we should look at each country’s reserves and resources. Known resources are shown in the chart below. We see some of the main producers near the top of the list. But we also see several countries that do not produce any lithium. Bolivia has the largest resources.

Our ability to increase lithium production might be limited to a few countries with production capacity already at scale, but over longer timeframes, many more countries could enter the race.