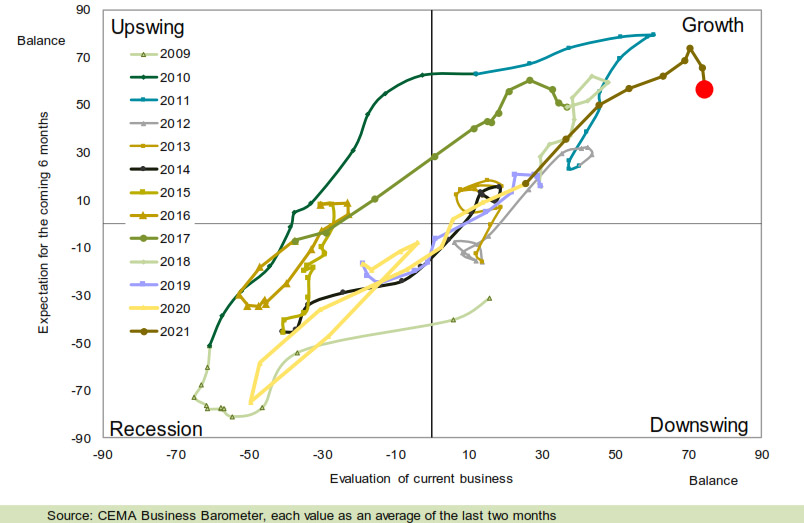

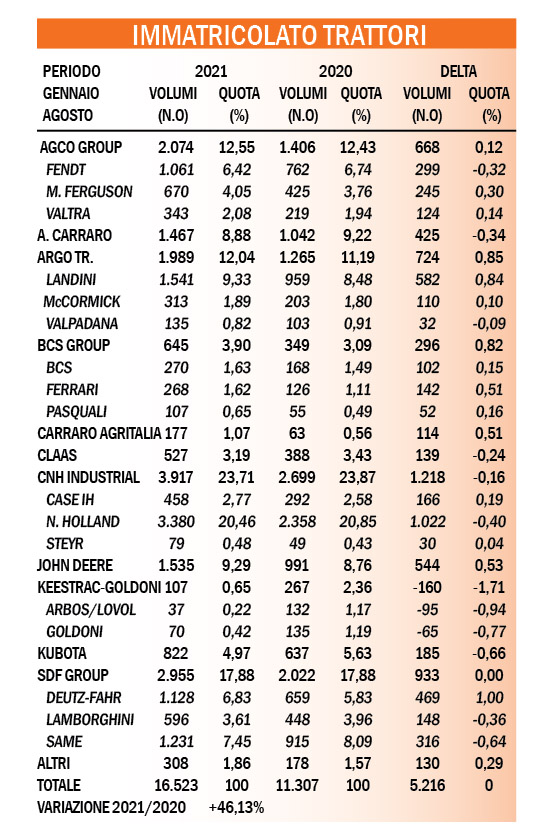

At the end of May, tractor registrations had grown by almost 60 percent compared to the first five months of 2020. At the end of August, the growth decreased, while remaining substantial at over 46 percent. All the operators agree that the apparent slowdown is due only to the supply problems of raw materials and components. Problem that pervades the entire global manufacturing industry. If the production lines could work at full speed, the agricultural mechanization sector would therefore experience a real boom.

At the base obviously the state aid in place. Those same, however, that will be reduced starting from next January and, subject to any exceptions, will close at the end of 2022. This is why there are already those who hypothesize a future collapse in registrations. This is also due to the fact that a tractor is a durable and not a consumer good.

Electric tractors emerge as viable alternatives for some operations

Electric tractors emerge as viable alternatives for some operations

Whoever wanted or wants to buy has bought or is buying and therefore it is physiological that the market will slow down in the short term, regardless of the aid. It is therefore no coincidence that there are many hopes for the establishment of a less generous but structural policy. So as to allow farms to invest on the basis of medium-term programs and not just to take advantage of contingent situations.

At the end of 2022 it will be understood whether this will materialize or not. While it will be enough to wait just a few months to know if 2021 will close with a volume of registrations which, according to the current trend of the mobile year, will exceed 23 thousand units. In the meantime, all the manufacturers have the opportunity to toast their respective successes with the only exception of Goldoni, which has not yet benefited from the acquisition by the Keestrac group , and the Arbos brand, probably destined to disappear and return to history. .

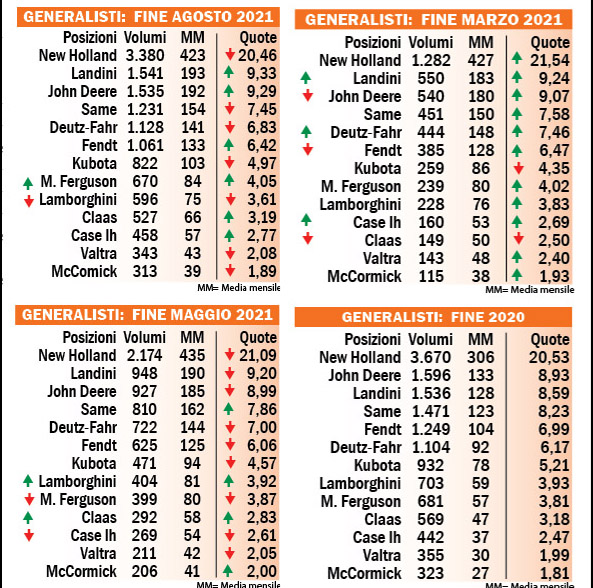

The ranking of registrations is practically unchanged compared to the end of May. With New Holland always leading the pack, but this is nothing new, followed by Landini and John Deere . Brands competing for the place of honor. The Same brand that precedes the Deutz-Fahr cousins , in fourth place among the generalist manufacturers, is more detached , however, being fifth overall behind Antonio Carraro . The Fendt and Kubota brands are recovering on Deutz-Fahr , while Massey Ferguson returns in front of Lamborghini , which Claas is also slightly close toin Case Ih . To close the two technological brands of the Agco and Argo groups , Valtra and McCormick .